A year in review: how the Australian property market performed in 2018

Emily is a Sydney-based real estate writer.

Learn more about our editorial guidelines.

With the cooling of the Australian property market foreshadowed by the January 2018 Hedonic Home Value Index, the real estate landscape painted a rather gloomy narrative from the very beginning of last year. And while many were hoping for a plot twist, housing market conditions continued to consistently decline, concluding the year with national dwelling values down -4.8%.

However, not all was bad news in the real estate market, as the prestigious property sector emerged as a hero with some incredible sales of trophy homes.

Here are all the top stories that stole the limelight in the Australian property market in 2018.

Record breaking real estate sales of 2018

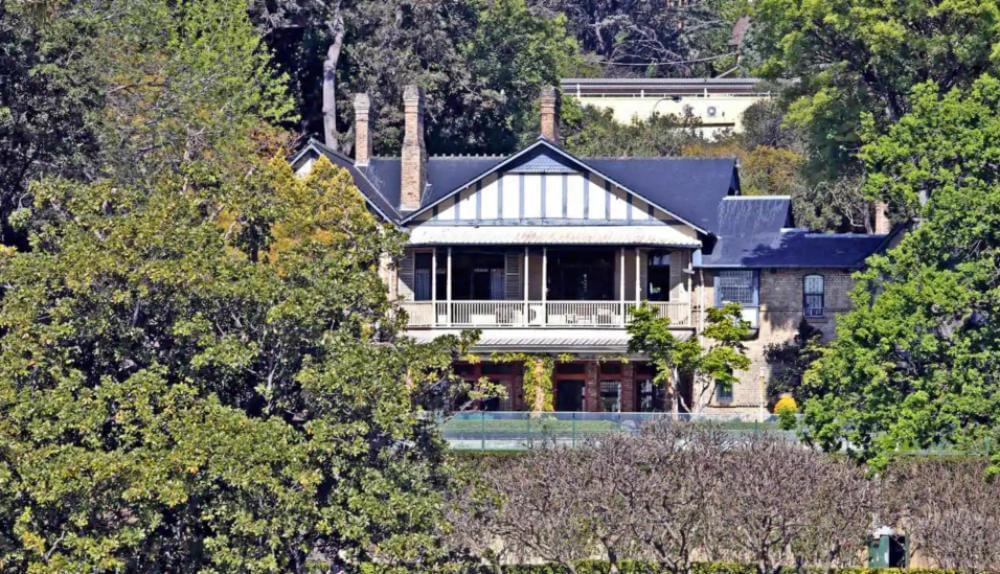

Despite the cooling of the market, the year ended with a cherry on top for the prestigious property market in Sydney with the sale of the most expensive house in Australia.

Atlassian Co-Founder Mike Cannon-Brooke dropped a cool $100 million to purchase Point Piper mansion ‘Fairwater’ from Lady Mary Fairfax in September. This purchase eclipses the previous record of $70 million held by neighbouring property owner and fellow Atlassian Co-Founder Scott Farquhar who purchased his home the year prior.

Stretching from New South Head Road to Seven Shillings Beach, this 11,210 sqm estate is the largest privately owned piece of real estate on the Sydney Harbour.

Melbourne also had a slice of the prestigious real estate cake with art dealer Rod Menzies selling his Malvern mansion, ‘Stonington’, for $52.5 million - shattering the previous record by $12.5 million. According to The Age, this former Australian Government House has entertained guests such as the Dame Nellie Melba and the Duke and Duchess of York.

Shake up of rental laws

2018 was a big win for renters as new reforms and amendments in rental laws passed in Victorian and NSW Parliament. These changes, designed to increase protection and strengthen rights for tenants, came at a pivotal time as the number of people opting to rent continue to increase. This is supported by the 2016 census where the results showed that approximately one-third (31.8%) of residents in NSW and one-fourth (28.7%) of residents in Victoria are tenants.

"These changes, designed to increase protection and strengthen rights for tenants, came at a pivotal time as the number of people opting to rent continue to increase."

Some of the most significant changes in the tenancy legislations include:

- The ability for victims of domestic violence to immediately break a lease with no penalty if they have a provisional Apprehended Violence Order or a declaration from a medical professional.

- The means to make minor modifications to rental homes without the consent of the landlord such as installing a wall hook to hang a photo.

- Limiting rent increases to once a year.

- Requiring rental properties to adhere to a minimum standard, such as basic access to electricity and gas, adequate natural or artificial lighting, and functioning stoves, heating and toilets.

- In Victoria, tenants will also have the right to keep pets, provided that they obtain written consent by their landlord. Landlords will only be able to prohibit renters from having pets if they obtain approval by the Victorian Civil and Administrative Tribunal.

Cracks in the system

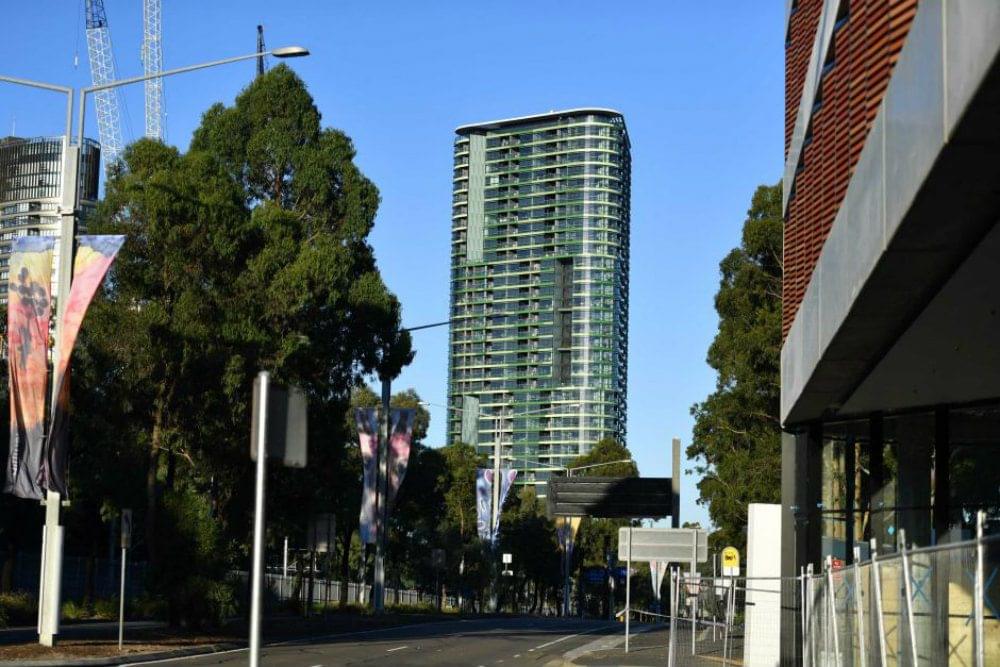

On Christmas Eve, residents of more than 50 units of the newly built Opal Tower in Sydney Olympic Park were evacuated after significant cracks on the walls of the 10th floor were heard and spotted. Engineers were forced to install giant metal beams to prevent cracks from widening on the 36 storey building.

A further blow for residents came after reports of newly formed and discovered cracks on level 4 were later made to authorities. Around 300 people were displaced from their homes, unsure of when it’ll be safe to return.

The developer of the building, Ecove, released a statement defending the building as “high quality”, stating that “full liability on the design and construction” was with outsourced building company, Icon.

In light of the situation, Icon also released a statement insisting that the building is structurally sound and the relocation of the residents is merely a precautionary measure.

The tower is currently undergoing a full internal and government investigation.

Credit squeeze

According to UTS Business School industry professor and former ANZ Chief Economist Warren Hogan in the AFR, the drop in house prices seen this year - particularly in Sydney and Melbourne - appear to be the result of banks tightening lending criteria.

This credit squeeze came about in response to the Royal Commission interim report shedding light on the misconduct of financial services firms who lent more than borrowers could afford.

This has restricted the amount of credit available to prospective home buyers through the reduction of maximum amounts that can be borrowed and the increased rejection of home loan applications.

Off the plan

Once an extremely attractive option for investors and first home buyers, off the plan properties have declined significantly as national dwelling prices continue to plummet.

Buyers who have secured purchases years in advance, when the market was at its peak, are now experiencing a struggle to secure sales as valuations are below what the properties were originally worth.

"Buyers who have secured purchases years in advance, when the market was at its peak, are now experiencing a struggle to secure sales as valuations are below what the properties were originally worth."

Issues typically arise when a bank values the property after its completion. If the bank doesn’t value the property as high as the original amount agreed to be paid, they won’t lend as much as is needed.

Coupled with tighter lending criteria, this has left many Australians in the stressful situation of needing to generate more money than expected.

How real estate in the major cities performed in 2018

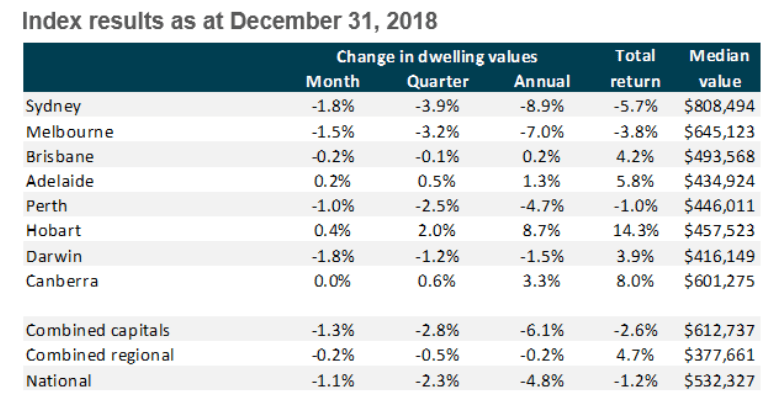

According to CoreLogic, Australia’s two largest cities were the primary drivers for the weaker national reading relative to 2017. The downturn in housing conditions accelerated throughout the year and finished with national dwelling values down 4.8%.

Sydney real estate market 2018

After peaking in mid 2017, Sydney recorded significant quarter to quarter declines throughout the year, with median home price falling -8.9% in 12 months and dropping $75,948 in median house value.

Sydney was the weakest performing capital city over the three months to December (-3.9%) and experienced the lowest rental yields at 3.3%.

At the end of 2018, Sydney values were reported to be back where they were in August 2016.

These results are in line with the OpenAgent Sydney seller sentiment where index scores were shown sharply declining between Q1 and Q2, falling from +3.1 to +1.1, which has been the largest quarterly drop in two years.

Melbourne real estate market 2018

Melbourne has also been one of the primary drivers for the weaker national reading in 2018 with CoreLogic Hedonic Home Value Index results in August ranking Melbourne as the weakest capital city housing market with values falling -2% over the three months.

In addition to this, Melbourne dwelling values have also dropped -7.0% in the twelve months leading up to December, translating to a decline in median house prices from $721,128 in January to $645,123 in December.

"... Melbourne dwelling values have also dropped -7.0% in the twelve months leading up to December, translating to a decline in median house prices from $721,128 in January to $645,123 in December."

Currently, Melbourne values are equivalent to what they were in February 2017.

Melbourne seller sentimentscores began to decline, with the index falling 1.4 points between Q1 and Q2, confirming the first turn of the property market in Melbourne in the past decade.

Brisbane real estate market 2018

Brisbane seller sentiment has seen modest but positive change in terms of capital growth.

Median dwelling value increased by $2,032 over the last 12 months, with annual change in dwelling value ending December at 0.2%. The month on month housing conditions remained unchanged.

The stability of Brisbane comes as a result of continued employment growth and the demand for property expecting to increase, as major infrastructure developments continue.

The Consumer Sentiment is in line with these results and remain relatively stable with the biggest difference in scores between Q3 2017 and Q2 2018 only being 0.6 points.

Adelaide real estate market 2018

Adelaide was a top performer for quarterly price growth, rising 0.5% over three months to the end of August, which was the highest increase for any capital city.

Real Estate Institute of South Australia CEO, Greg Troughton stated that Adelaide’s housing demand by both local and interstate buyers had made it a strong market competitor.

Median dwelling values increased in Adelaide from $432,641 to $434,924 over the 12 months leading up to December 2018, translating to an increase of 1.3%.

The Consumer Sentiment of Adelaide reflected this with the index rising 0.7 points from +3.8 in Q1 to +4.5 in Q2.

Perth real estate market 2018

Following the end of the much acclaimed mining boom, it’s no secret that the Perth property market has substantially declined since June 2014. Not only have annual dwelling values dropped -4.7% by the end of December 2018, but so have rental returns for investment properties. This has seen many mortgage repayments become unsustainable, as properties go untenanted.

The issue at hand is seen to be the disproportionate increase in housing stock while growth in Western Australia was still strong. This has left the city with an oversupply of properties that need to be absorbed in order for the market to recover.

As of the current moment, Perth values are back to levels last seen in March 2009.

Darwin real estate market 2018

Dropping -1.5% over the course of 2018, the Darwin property market saw median dwelling values dip from $423,926 in January to $416,129 in December. Despite the seemingly small decrease in comparison to the likes of Sydney and Melbourne, recent data from the NT Real Estate Institute show Darwin’s house prices being the lowest they have been since 2009.

According to the ABC, the Territory’s small population and end of the INPEX construction phase has cut more than a billion dollars out of the residential property value - amounting to a 53% drop in 4 years.

Canberra real estate market 2018

While other major cities have seen significant drops in their property markets, house prices in Canberra have bucked the national cooling trend with median house values increasing by 3.3% over the last 12 months.

Canberra home owners have reaped the benefits of six consecutive years of property growth supported by flowing housing finance, rising purchasing activity and low interest rates.

What’s in store for 2019?

There are many differing opinions on what’s in store for the Australian property market in 2019. Several industry experts believe that the falling house price trend will continue as tighter lending standards from banks and financial regulators increase. However, others remain optimistic, believing that property prices will fall at a slower pace during the first half of 2019, before entering a new phase of moderate growth in the latter half.

Read more about what’s ahead in 2019 for each major city: