Auction clearance rates have hit a two year high - what does this mean for the market?

Emily is a Sydney-based real estate writer.

Learn more about our editorial guidelines.

If you’ve been watching the property market over the last four weeks, you’ve probably noticed that auction clearance rates have been slowly making a come back, especially with the most recent results from last weekend.

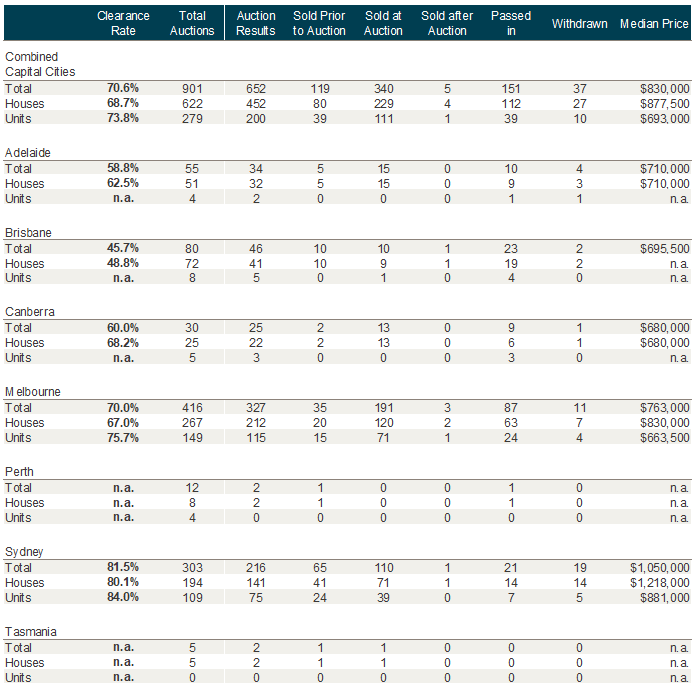

Across the country, capital city clearance rates hit their highest levels in over a year, reaching a preliminary high of 70.6% collectively, with nine-hundred and one homes going to auction, according to CoreLogic.

Over the same week last year, auction activity was higher, with 1,257 homes taken to auction, returning a clearance rate of 57.0%.

Sydney led the charge, recording an impressive preliminary clearance rate at 81.5%, with 303 homes going under the hammer.

Melbourne recorded the second-highest preliminary clearance rate at 70%, with 416 homes going to auction.

Across the smaller markets, Brisbane and Adelaide were not far behind, with clearance rates of 45.7% and 58.8% respectively. Perth’s clearance rate remained relatively unchanged.

National year-on-year comparison

Clearance rate

70.6%

Total auctions

901

Clearance rate last year

57.0%

Total auctions last year

1,257

Source: Corelogic Capital City Auction Statistics (preliminary)

Capital city breakdown: year-on-year comparison

Sydney

| Clearance rate | Total auctions |

|---|---|

| 81.5% | 303 |

| Clearance rate last year | Total auctions lasts year |

|---|---|

| 55.2% | 407 |

Sub-regions of interest:

- Baulkham Hills and Hawkesbury - recording a clearance rate of 90.0%

- City and Inner South - recording a clearance rate of 81.0%

- Inner South West - recording a clearance rate of 93.3%

- The Northern Beaches - recording a clearance rate of 92.9%

Melbourne

| Clearance rate | Total auctions |

|---|---|

| 70.0% | 416 |

| Clearance rate last year | Clearance rate last year |

|---|---|

| 59.9% | 613 |

Sub-regions of interest:

- Inner East - recording a clearance rate of 75.0%

- North East - recording a clearance rate of 81.6%

- South East - recording a clearance rate of 76.9%

Brisbane

| Clearance rate | Total auctions |

|---|---|

| 45.7% | 80 |

| Clearance rate last year | Total auctions last year |

|---|---|

| 43.8% | 94 |

Adelaide

| Clearance rate | Total auctions |

|---|---|

| 58.8% | 55 |

| Clearance rate last year | Total auctions last year |

|---|---|

| 72.1% | 67 |

Perth

| Clearance rate | Total auctions |

|---|---|

| 50.0% | 12 |

| Clearance rate last year | Total auctions last year |

|---|---|

| 29.4% | 19 |

Tasmania

Is the market on the up?

While early signs show that the market is bouncing back, OpenAgent Data Analyst Carson Teh says that it’s a bit too early to call and that we should take these auction clearance rates with a grain of salt.

“While in most capital cities we see that clearance rates are increasing year-on-year, we need to understand that this time last year there was actually more stock on the market.”

“Less stock can drive up clearance rates - but it’s not a case of doom and gloom. With more buyers coming onto the market, there’s more demand and less stock to go around - as a result, homes selling above reserve is a more likely occurrence.”

Teh says the market does seem to be picking up; more people are attending open homes and more people believe prices are on the rise.

“Our latest Consumer Sentiment research shows that sentiment is bouncing back, with the majority of Sydney and Melbourne sellers believing property prices will increase within the next six months.”

We hear a lot of speculation in the media, with industry pundits pointing to a lot of positive factors influencing the property market. One of the biggest positive influences driving increased buyer activity in the market is the RBA cutting the official interest rate two months in a row, as well as the loosening of lending making it easier for buyers to get credit.

This coupled with the election results we saw in May means buyers feel less deterred by proposed changes to negative gearing and capital gains tax policy if a Labor government had come into power.

According to Teh, spring will be a good test. “It’ll be interesting to see if these auction clearance rates are sustainable.”

“Spring has historically been a time in the annual property cycle where stock levels start to increase, so with more stock on the market, we’ll all be watching in anticipation to see if these high clearance rates continue.”

Find out more about how to understand auction clearance rates and the data indicators you should be watching as an active buyer or seller.