When will the property market bounce back?

Samantha is a Sydney-based real estate and home improvement writer. She is currently Head of Marketing at OpenAgent.

Learn more about our editorial guidelines.

With the number of new daily reported Covid-19 cases trending down, and Prime Minister Scott Morrison starting to ease restrictions within the health sector, it seems that a slow return to normalcy is looking promising.

With all this in mind, it begs the question, at what point can we expect the property market to turn around?

Prior to Covid-19, the property market was in a great place. Auction clearance rates were high, the average time to sell was trending downwards, interest rates were low, and from a values standpoint, dwelling prices were on an upward trajectory.

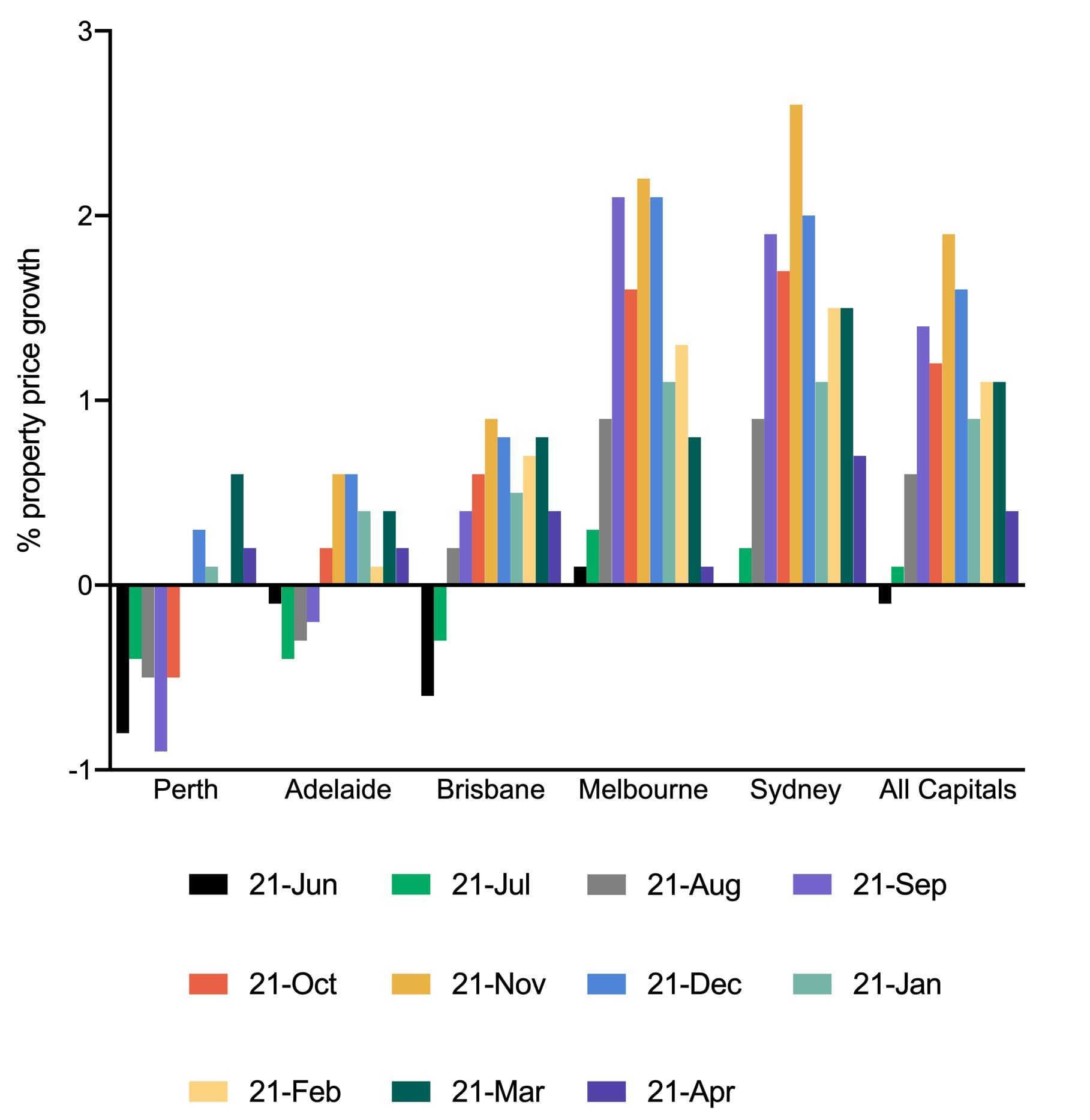

In fact, regardless of Covid-19’s market disruption, in the last month alone, most capital cities recorded positive growth, even if it was less than 0.5%. But if we look at housing values over a longer period, all capital cities in the chart below managed to maintain positive price growth over the last six months.

What can we expect prices to do in the long run?

While every market is different, growth has definitely slowed down, with the biggest contributor being the social distancing measures that halted public auctions and open-for-inspection activity.

But how much will housing values drop? St George Bank released a preliminary forecast around property price movements on Wednesday.

The forecast projects a 7-10 percent decline in housing values as a result of job losses and a weaker economy, and a 2 percent rise in values at the start of 2021, if the economy recovers as it’s expected to.

The report states that “stimulus measures will provide fuel for rapid housing price growth once the broader economic recovery begins” and that given the unprecedented assistance from the government and financial institutions, the housing market could be insulated from a major crash.

Industry experts have so far been resistant to provide price predictions, given how unpredictable and widespread the coronavirus pandemic is. St George has accepted these restraints by stating that the forecasts had “a greater degree of variability attached to them than usual”.

“There is significant uncertainty around how far [prices] can fall,” they said.

The forecast also noted that social distancing restrictions such as open-for-inspection and auction bans would negatively affect the property market, but with some restrictions already being loosened in the health sector, could circumstances potentially change sooner than we think?

According to SQM Research Property Analyst Louis Christopher, if we can get to zero Covid-19 cases by the end of April, there’s a chance some of our social distancing restrictions could be somewhat loosened in May.

"The St George bank forecast projects a 7-10% decline in house values and a 2% rise in values at the start of 2021."

“My bet is that when restrictions are eventually lifted, they will be lifted in the reverse order that they were placed on to begin with.

“As the ban on auctions occurred as one of the last stages, it is quite feasible that lifting that ban could come sooner than expected,” Mr Christopher said.

If the market can return to some level of normal operation, even if some social distancing measures are still enforced, then confidence in the housing market is likely to return.

Are some markets better placed than others?

According to the latest Domain House Price Report released on Thursday, there are some regions in Australia that are likely to perform better than others.

Domain Senior Research Analyst, Dr Nicola Powell noted that Adelaide and Canberra were likely to hold steady during the pandemic, with Adelaide benefitting from having quite a stable market.

“Adelaide is somewhat insulated from a downturn in terms of foreign buyers and investors, it’s largely an owner-occupier market,” Dr Powell said.

Alexander Ouwens, Co-Director of Adelaide’s Ouwens Casserly Real Estate echoed these observations.

“We don’t have the peaks and troughs. The sentiment doesn’t change quickly here because we don’t have the workforce that is reliant on tourism or any one kind of sector that is highly impacted by market sentiment,” Mr Ouwens said.

“If you can compare crises, when we look back at the GFC, 9/11 or Wall St, Adelaide properties have always been really resilient and come off maybe 5 percent, and then bounce back quickly,” he said.

Ouwens Casserley primarily trade homes around the $700k to $1.5m mark, as well as some multi-million dollar homes. And in current market conditions, they’re finding that family homes are moving quite quickly and that prices are holding steady.

“Across the board, and across all of our offices that service different markets, we’re seeing that that middle market is holding strong,” he said.

Mr Ouwens says that their offices sold 10 properties last week in one of Adelaide’s best council areas and remain undeterred in the current climate.

"Across the board, and across all of our offices that service different markets, we’re seeing that that middle market is holding strong."

“Our top agents are saying it’s a really good market to sell in because it’s given a good excuse to really qualify the buyers before we show them through [the property],” he said.

Mr Ouwens is sensing growing sentiment in the market too.

“In South Australia we’ve had three or four days in a row without new cases of Covid-19… it feels as if we might have some easing of restrictions in the next couple of weeks.”

According to Adelaide agent Matt Sargeant, investors aren’t being spooked by current conditions either.

“You can buy a house in our marketplace for $250,000 and rent it out for $300 a week and with the interest rates as low as they are, your repayments aren't going to be $300 a week they’re probably going to be $230 a week. So I can’t see the market dropping any further,” he said.

According to Domain, the Canberra property market is also behaving differently to the rest of the country. Searches are up year on year, enquiries for houses are increasing, and there is an increase in listings.

While the Perth property market hasn’t shown any significant changes, it is likely to do well if the state can maintain a strong mining sector.

Earlier this month Tim Lawless, CoreLogic’s Head of Research noted that capital growth trends will be contingent on how long it takes to contain the virus, and whether additional constraints on business or personal activity are introduced.

With Australia’s current handling of the virus, and restrictions already being eased in our health sector, if lockdown measures are rolled back even further before the proposed six-month period, the housing market could bounce back sooner than we think.

According to Ms Leah Calnan, President of the Real Estate Institute of Victoria,“if we can get through this and into spring then we should see the market return. People need to have property transactions.”

Domain’s Dr Powell echoed similar sentiments, “During this shutdown period I think what we’ll see is pent-up demand, and what we’re likely to see at the end of this is a strong recovery.”