2024 Australian property market outlook - a return to 'normal'?

Another remarkable year for Australian real estate is coming to a close, paving the way for what promises to be an interesting 2024.

With many markets around the country having fully recovered from the downturn of 2022, will the momentum continue in the months ahead or can we expect another shift?

Find out what the experts are saying about the future of Australian property.

Get a free property value estimate

Find out how much your property is worth in today’s market.

2023 is ending with prices back at record levels

Before diving into forecasts for the new year, it's worth reflecting on how expectations were shattered in 2023 by a stubbornly resilient market.

Despite the fastest interest rate hiking cycle in Australia's history, home values rocketed back up over the course of the year, setting a new national price record in November according to CoreLogic.

Tim Lawless, CoreLogic's research director, explained that "The 'V' shaped recovery may seem counter-intuitive, given high interest rates, deeply pessimistic levels of consumer sentiment and high cost of living pressures, however, the recovery can be explained by an imbalance between supply and demand."

The shortage of new listings that persisted from spring 2022 to mid-way through 2023 forced buyers to compete harder in an undersupplied market, driving prices up.

That supply and demand imbalance was magnified by record levels of population growth, a lack of new builds being completed, and an exceptionally tight rental market pushing more tenants to become first home buyers.

November saw a downshift in some markets, though, as affordability began to bite and another interest rate hike rattled consumers. So where to from here?

Interest rates are expected to hold steady throughout 2024

The past two years have been testing for many Australians as the RBA's fight against inflation resulted in the cash rate climbing from virtually zero to 4.35 per cent by November 2023.

Thankfully, after a run of 13 rate hikes in 18 months, it's widely forecast that we're finally at the peak of the tightening cycle.

Three of the big four banks expect that November was the final increase, with just NAB predicting a further 0.25 per cent to come in February 2024. From there, rates should hold steady until cuts potentially beginning late into the year.

Big four banks' cash rate forecast 2023-24

| Bank | Peak rate forecast | Month of peak rate | Rate cut forecast | Month of trough |

|---|---|---|---|---|

| Westpac | 4.35% | November 2023 | 2.85% | December 2025 |

| NAB | 4.60% | February 2024 | 3.10% | February 2026 |

| CBA | 4.35% | November 2023 | 2.85% | May 2025 |

| ANZ | 4.35% | November 2023 | 3.35% | June 2025 |

Real estate expert and buyer's agent Pete Wargent said that current indicators "suggest that interest rates are going to be on hold for quite a long time most likely."

After an extended period of uncertainty around where rates would go next, some relative stability should help Australians make their property plans in 2024.

"Interest rates are higher than they were, but at least people can see where they're going to be. People can start to make decisions with more confidence, both buying and selling," he said.

Price growth is likely to moderate in the new year

Anyone who's in the business of property market forecasting has been treated to an endless string of surprising twists over the past few years.

By the end of 2022, with interest rates rising sharply and home prices falling, many experts predicted 2023 would see the downturn continue at pace. As it turns out, they couldn't have been more wrong.

With that in mind, most forecasters are approaching the upcoming year with cautious optimism, suggesting that price growth will continue at a more gentle rate.

The big four banks are unified in predicting anywhere between +4 and +6 per cent growth nationally for 2024 — a moderation from the +8.3 per cent gains seen since January this year.

The Australian Financial Review recently surveyed ten leading economists on their price expectations for 2024 and found their combined outlooks also averaged out to growth of +4.8 per cent.

Of the capital cities, Perth and Brisbane are the most widely tipped to outperform in the new year, with more modest movements forecasted for Sydney, Melbourne and Adelaide.

Australia's housing markets are still supported by strong fundamentals

While interest rates are likely to remain high for months to come and affordability pressures are slowing growth in some areas, there are a number of key factors helping to underpin the strength of Australia's property markets.

Population growth is expected to continue at a historic pace in the new year, stoking buyer demand at a time when housing is in short supply for the population we already have.

Rental vacancy rates are still around record lows, pushing more people into the buyer pool, and any proposed solutions for the rental market aren't likely to make a significant impact over the next 12 months.

Pete Wargent commented that, while mortgage stress is a problem that will carry over into 2024, arrears and defaults are rising from very low levels, as is unemployment, making a widespread rush of distressed listings unlikely.

The more affordable end of the market should be particularly well supported as buyers facing reduced borrowing capacities are pushed down to lower price brackets. Mr Wargent proposed that this could help narrow the gap between unit and house prices.

Overall, he said that we're most likely looking at a more balanced market ahead in 2024.

"It's been like a whipsaw the last few years. Everything has been so volatile and hard to predict. I'm expecting a much more stable and normal market [next year]."

Thinking of selling in 2024?

If you're still looking to get in on the action this coming summer, it's important to be as prepared as possible in order to cut through the competition and achieve a standout result.

Step 1: Understanding how your market is performing

Every market is different, and understanding your local market is fundamental to making the right selling decisions. Our guide to tracking market trends and data will help you to get a clear picture of how your market is performing and how that impacts you as a seller.

Step 2: Know what your property might be worth

Getting a free home value estimate is a great way to set a foundation for your selling expectations and begin planning the path forward.

Step 3: Get a no-obligation market appraisal from a top real estate agent

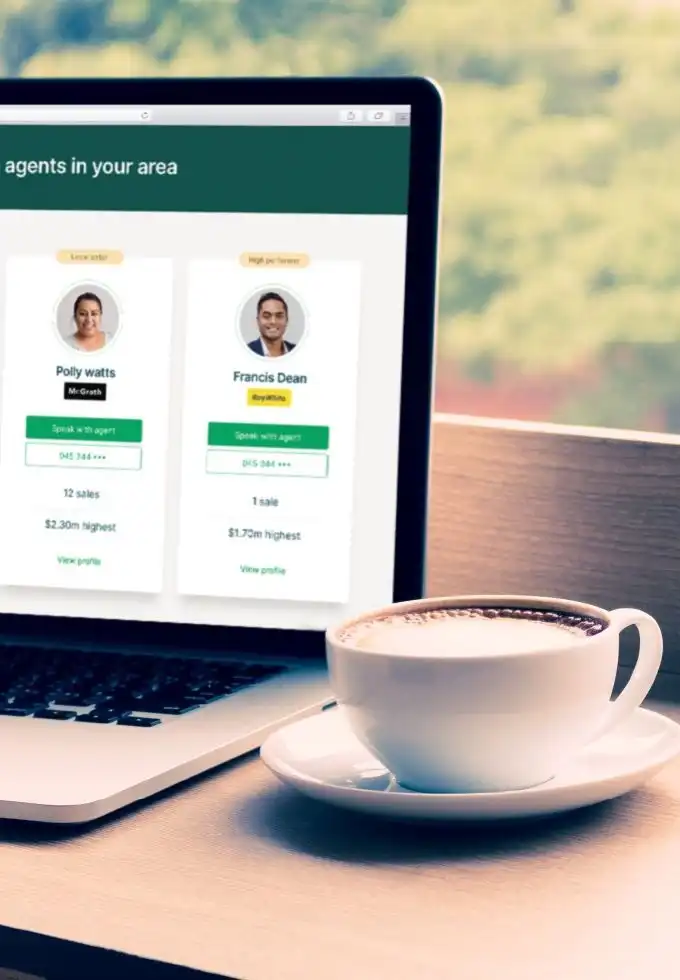

Understand what your property could sell for in the current market by speaking to the top-performing agents in your suburb. Comparing top agents in your area will help you find the perfect partner for your selling journey and move towards a successful result.

Step 4: Finally, get your property listing-ready

Taking a thorough approach to preparing your home for sale is another critical step. From cleaning, decluttering, painting and performing other cosmetic renovations to home staging, photography and marketing, getting your property to sale-ready condition is a must.