Can further rate hikes stop property price growth?

Few economists predicted property price growth would return in 2023, yet just halfway through the year, we've already seen strong gains across the country.

Seeing the cash rate hiked beyond 4 per cent was also unexpected, though, and will surely have an impact on the property market.

Can prices continue to rise despite the high-rate environment or is another correction up ahead?

Get a free property value estimate

Find out how much your property is worth in today’s market.

Low supply and growing demand continue to underpin strong prices

The key driver of returning price growth in 2023 has been an imbalance between supply and demand.

Listings have held well below average since September last year and the stock shortage has only set in further through the early stages of winter.

Buyer demand, meanwhile, has continued to ramp up as record overseas migration and a relentlessly tight rental market have seen more and more people out there actively looking to purchase a home.

As buyers have been forced to compete over what little is on the market, auction clearance rates have been bolstered back to 'hot market' levels and prices have clear upward momentum.

We could see listings begin to climb back towards average levels over the second half of the year, though.

CoreLogic's research director Tim Lawless concluded that "at the moment we aren’t seeing any signs that advertised housing stock is rising, at least at a macro level. This will be a key trend to watch moving forward."

Banks are still forecasting another rate hike

On the other side of the equation is the rising cash rate and its slow-release effects.

The latest indicators seem to show that inflation is on the decline, however, three of the big four banks still predict the hiking cycle isn't over, possibly bringing the cash rate all the way up to 4.60 per cent.

"Forecasts on where the cash rate will land and how long it will stay elevated vary, but it’s likely there is at least one more rate hike to come, potentially more," Mr Lawless said.

The full impacts of the 13 rate rises so far are still to be felt. One of the key concerns is around rising mortgage stress leading to forced home sales.

If a significant number of properties are listed at reduced prices in order to achieve a quick sale, that could have

Borrowing capacity is another major factor. Since interest rates began lifting in May 2022 from record-low levels, buyers have seen their maximum borrowing amount slashed by more than 30 per cent.

Affordability is already a critical issue for many in the housing market, so any further reductions in lending potential could put downward pressure on home prices.

Listings could rise during an active spring selling season

Spring is typically the time when the property market bursts back into action and we may see that usual dynamic play out in 2023.

"With the demand out there, and if people are starting to believe that we are at the peak of this interest rate cycle, people are going to be more inclined to make a change," Ray White Nerang's Brenton Buttigieg explained.

"I'd be very surprised if it's not a very active spring."

If listings do increase substantially this spring we could see a rebalancing of supply and demand, helping to put the brakes on the strong price growth seen recently.

That's the outcome that Shiv Nair of Ray White TNG sees happening this year.

"There will be a high influx of properties in the coming months. From a seller's point of view, the advice is to sell now and beat the rush," he said.

Thinking of selling in 2023? Here's what to consider

If you’re still on the fence about selling, we get it. It’s a huge decision that deserves all your careful consideration weighing up the advantages and disadvantages for either scenario.

Even if the market feels uncertain, it’s important to remember that it’s all relative and the market doesn’t stop. There will always be properties being listed and buyers out there wanting to purchase a home.

It's also crucial to recognise that conditions will vary from suburb to suburb, so it’s important to understand your own local market — and to do that, you really need to get granular.

Whether your property is impacted by price gains or falls depends on many factors including location, property type, and whether your home falls into the higher or lower end of the market.

If you’re seriously considering selling your home, you need to do your research. As a first step, get a free ball-park estimate of what your home might be worth in today's market.

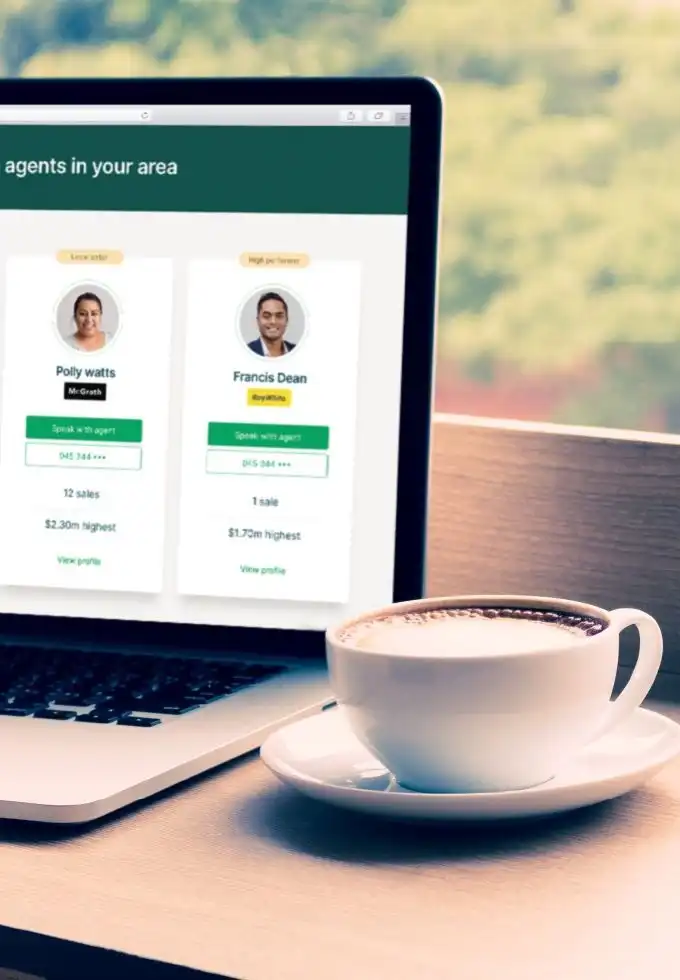

Speaking to a top local agent is also one of the best ways to get a thorough understanding of how buyers are behaving in your suburb, what kinds of results are still being achieved, and what the best strategy could be for you to still get that dream sale result.

At the very least, it’s helpful to hear what properties are selling for, what demand is currently like for homes like yours, and to get a no-obligation appraisal of what your home might sell for in the current market. A top agent who knows your market like the back of their hand will be able to help you along the journey.