Experts say rising listings may mean falling prices

Huge buyer demand meeting a severe lack of supply was a key driver in Australia's property boom last year. That dynamic is changing in 2022.

Our markets are now diverging, and the performance of each city or region looks to be closely linked to the number of listings that are available.

Will an influx of new listings drag prices down? Where is the increase in listings slowing price growth the most? And what do sellers need to consider when timing their listing? We look to the experts to find out.

Where are listings rising and what does it mean?

CoreLogic's February home value index showed Sydney property prices falling slightly for the month, while Melbourne held flat at 0.0 per cent growth.

It may come as little surprise, then, that listings in both cities have been on the up.

While January is typically a slow month for Australian real estate, SQM Research data shows every market saw a massive monthly increase in new listings in February.

SQM's managing director Louis Christopher told the AFR "the upward surge in listings over February suggests some sellers are taking profits after phenomenal price rises were posted in 2021."

Total stock on the market was far below the five-year average for most of last year, but that's returned much closer to normal levels in Sydney and Melbourne especially, giving buyers more choice and stronger negotiating power.

Some locations are seeing this new listings trend accelerate rapidly. For example, SQM data shows new stock in Melbourne's inner east and Sydney's inner west surging.

"The stock build-up is likely a reflection of the slower spring season, but also a rise in vendors wanting to sell despite the slowdown in the market," Mr Christopher said.

He added that, in the case of Melbourne's inner east, "we're now seeing the pendulum swing towards the buyers in this market."

Are listings still low in some markets?

The rise in new listings isn't being seen in every city and region. Brisbane and Adelaide, for example, are still displaying a significant shortage in stock, and that's continuing to drive price growth in both markets.

In fact, when looking at Australia's four largest capital city markets, the correlation between advertised stock and current price growth is abundantly clear.

CoreLogic's latest report, which shows the annual change in total listings, illustrates a clear shortage of properties on the market in Brisbane and Adelaide, while Sydney and Melbourne have had their reserves topped up.

CoreLogic's head of research Australia, Tim Lawless, said, "the cities where housing values are rising more rapidly continue to show a clear lack of available properties to purchase.

"Total listings across Brisbane and Adelaide remain more than 20 per cent lower than a year ago and more than 40 per cent below the previous five-year average."

Regional markets share similar listing stats, again contributing to the strong gains that we've continued to see outside capital cities.

What do prospective sellers need to consider?

With so much change currently occurring across the country's real estate markets, it pays to keep a close eye on what's listings activity in your city or region.

If you're looking to sell in a market like Brisbane, Adelaide or regional Australia, where demand is still heavily outweighing supply, conditions are still looking very favourable right now.

While flood-affected areas are likely to experience a sudden drop-off in activity, for the most part, properties in these markets are fetching higher prices and spending less time on the market before selling.

In locations like Sydney and Melbourne, where advertised listings continue to rise and buyers have more and more choice, the seller's market we saw throughout 2021 seems to be transitioning.

Mr Christopher explained that "we could see the upward trend in listings continue through the first half of the year as sellers seek to take profits."

In this case, waiting until later in the year to sell could mean a less favourable environment for sellers, particularly if inflation continues to bite and variable interest rates rise.

Agents are broadly expecting another influx of listings coming to the market around Easter, so there may be a window of opportunity before then to beat the rush.

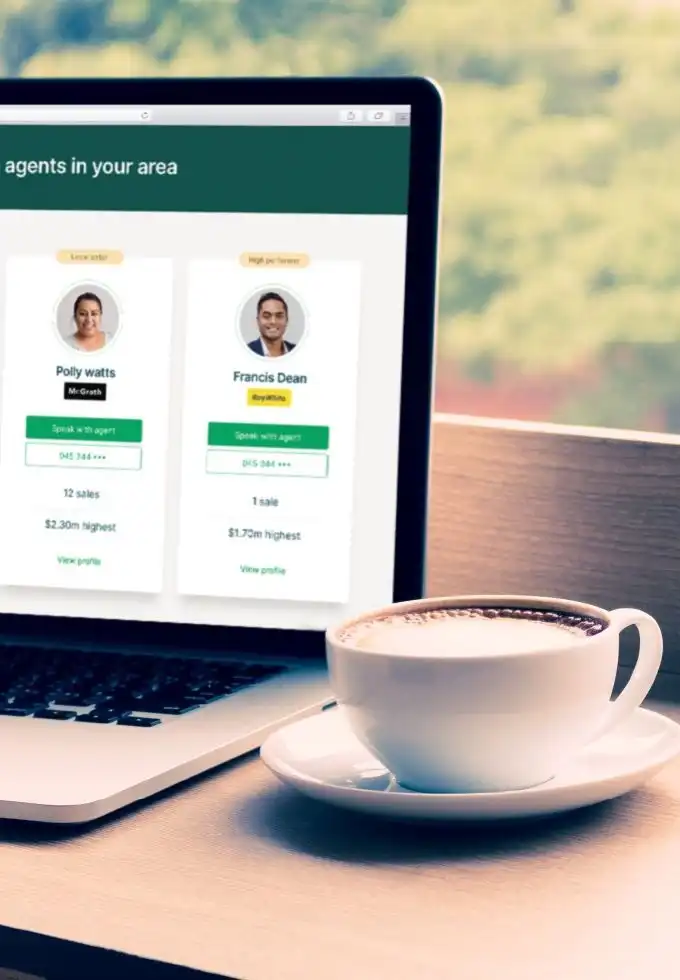

Naturally, every market is different, as is every property in that market. Speaking to a top local agent to get an understanding of the selling conditions now and in the future is the first step towards coming up with a strategy to achieve the best possible result.