Property Clock April 2021: which cities are rising and falling?

Every month, Independent property valuation firm Herron Todd White (HTW) releases a new residential property report which drills down into the market performance of cities around Australia.

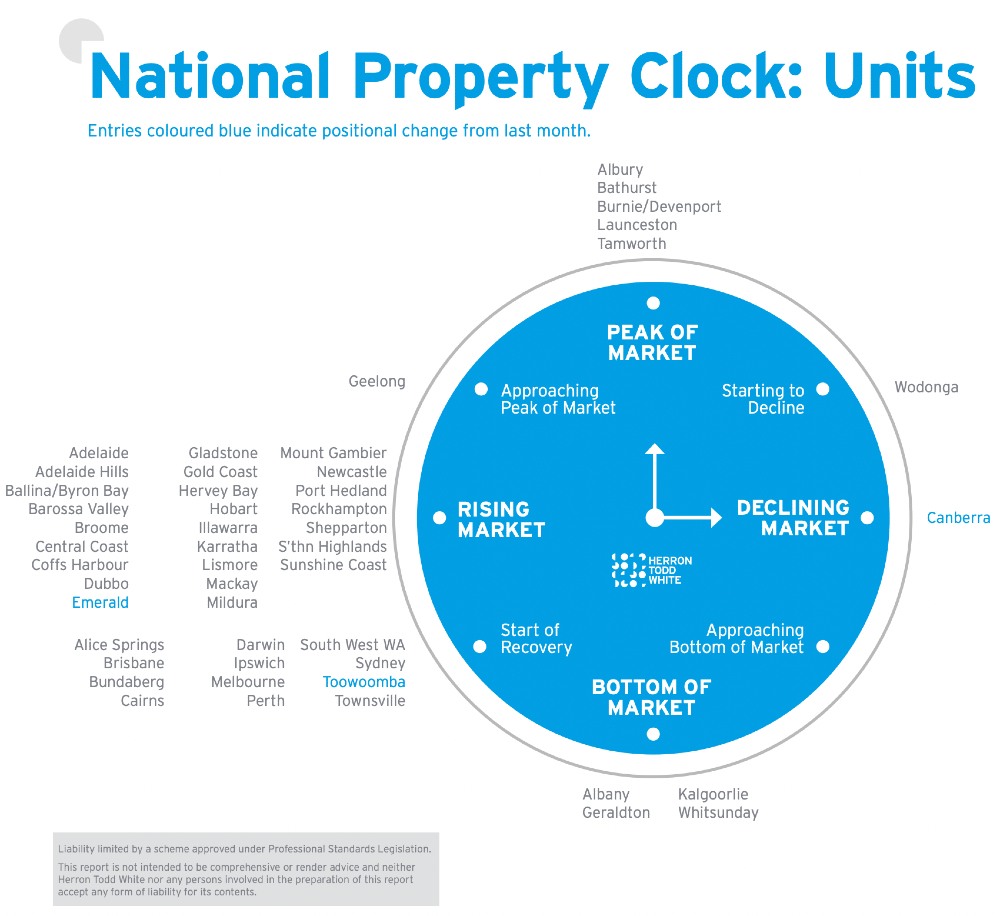

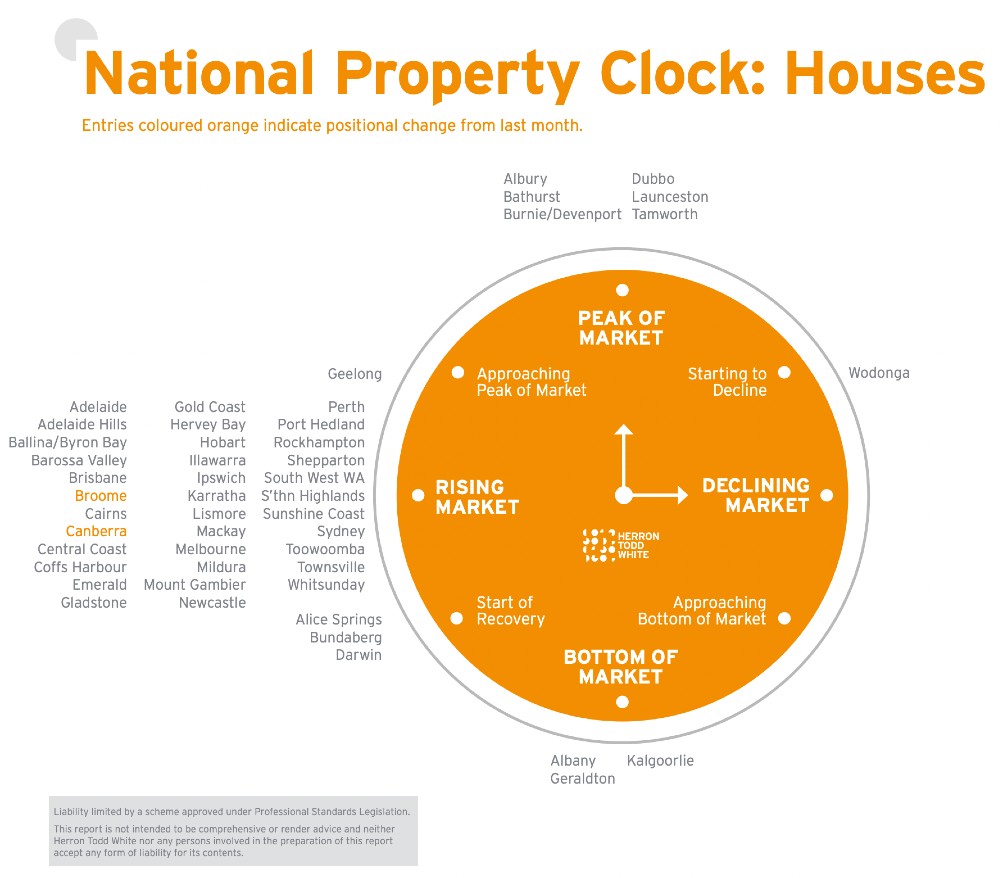

Leading each report is their 'property clock,' a graphic that plots where in the market cycle particular cities are predicted to be, whether it be rising, falling, peaking or bottoming out.

Similarly to last month's report, HTW's April clock is depicting broadly optimistic conditions, with the majority of cities' house and unit markets being declared as 'rising.'

That forecast aligns with the major banks' expectations for Australian housing for the rest of 2021 and continues the trend CoreLogic has been reporting over the opening months of this year.

So what are the key takeaways from this month's HTW report?

Cities at or approaching their peak

Regional hubs like Bathurst, Launceston, Tamworth and Albury have remained at the top of the clock since last month, suggesting that growth in these cities has reached a ceiling for the time being.

A notable change from the March report is Canberra. Previously HTW had placed the city's unit market in the 'start of recovery' category and houses at their peak.

This month, the Australian capital's fortunes have flipped.

The clock now has units in Canberra firmly on the decline, while houses are now expected to have further to climb as they slot into the 'rising market' category.

HTW property valuer Robert Moss explains the shift in house forecasts by pointing out that "[Canberra] suburb records are tumbling like skittles with eleven being scaled already this year and six falling in March alone."

Geelong is still projected to be approaching the peak of its market, and Wodonga is still beginning to slip down from its own peak.

Cities at the bottom or beginning to recover

In terms of what markets HTW consider to have hit their low point or are just starting their climb back up, not a whole lot has changed since last month.

Albany, Geraldton and Kalgoorlie stay planted in the 'bottom of the market' sector for both property types, with Whitsunday units joining them.

Units in state capitals Sydney, Melbourne, Brisbane, Perth and Darwin have also been marked as being at the 'start of recovery' stage, suggesting these cities are just at the beginning of an upcycle.

HTW Brisbane director David Notley says of his home city "there has been increased interest in attached housing from first home buyers—both units and townhouses.

"This compromise helps keep their purchase options affordable while still being able to buy in areas that are well serviced and accessible."

CoreLogic's latest numbers paint house performance far outpacing units around the country at the moment—median house prices in Australia have grown +8.6 per cent so far this year compared to +4.7 per cent for units.

As such, HTW's clock has just three cities held back at the 'start of recovery' point when it comes to houses: Alice Springs, Bundaberg and Darwin.

Cities on the rise

That leaves the bulk of the country sitting firmly in the 'rising market' category.

Houses especially are heavily represented here, with every state capital except Darwin being classified as on the rise.

Coastal destinations like Byron Bay, Cairns, the Sunshine Coast, South West WA, where supply is still not meeting demand, are also firmly in the rising quadrant for houses.

Like many regions, property valuer Mark Lackey says "The Byron Shire residential market remains strong, still buoyed by a mixture of interstate and intrastate migration, government incentives and stimulus measures."

Units in places like Broome, the Adelaide Hills, Illawarra and Mildura are also on the up, according to the clock.

HTW residential team leader Chris McKenna says many first home buyers are opting to go down the 'rentvesting' path—"where you rent a property to live in a location and style that suits and purchase a more affordable property in another location.

"The Illawarra can be a popular location for Sydney based rentvestors looking for more affordability than their local market," he explains.

It's a trend that's being seen more and more as priced-out first home buyers try to find a new way into the property market.