Property market showing early signs of recovery

No matter where you get your news from, it’s likely that you’re being inundated with plenty of opinions, commentary and predictions about the current state of the market, and where it’s likely to go.

Since Covid-19 started impacting the market over two and a half months ago, we’ve had plenty of economists forecasting price increases, and price falls. While there’s no doubt that Covid-19 and its associated restrictions are impacting the market, the danger of forecasts is that the media can cotton on to an unrealistic angle, that may be based on a worst case or best case scenario, and present it as fact.

With so much uncertainty, and with conditions changing quickly, there is a need to focus on what is happening right now, and what is most likely to happen in the immediate future. As we all continue to move through these uncharted waters, the best thing we can do is provide you with the facts.

Last month we reported on how the property market was performing in a Covid-19 world, looking at the period before Covid-19 and immediately after until the end of March. Today we aim to look at the market since that point, and provide you with recent data, commentary and insights to give you a view of how the market has changed since then, and how it may change in the immediate future.

Are transactions still slowing at a national level?

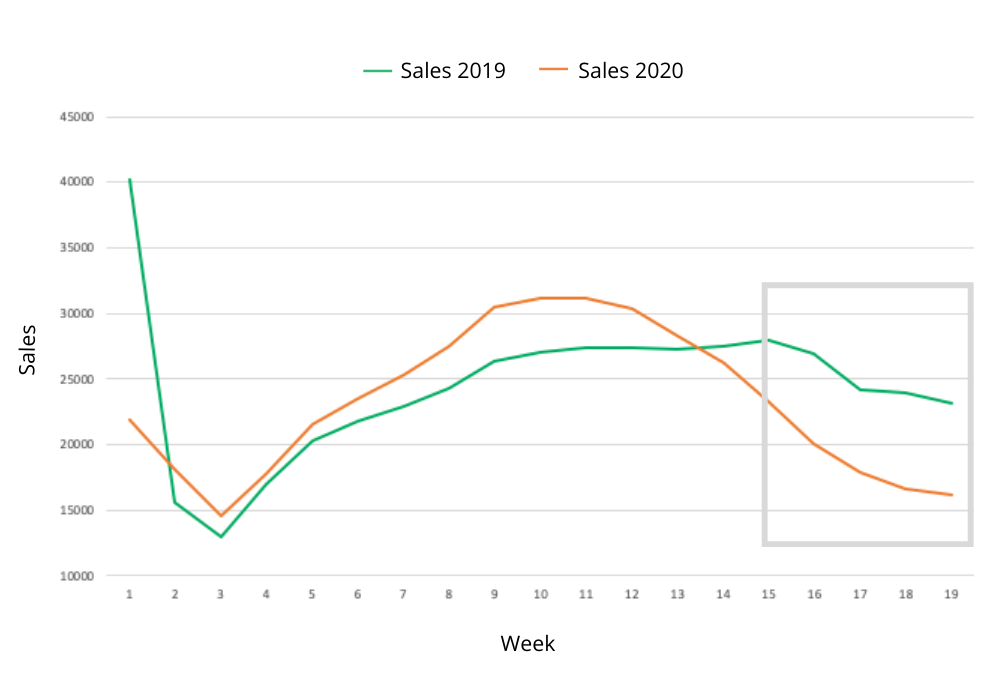

In our previous reporting on these numbers, we noted a 34% drop in sales volumes year on year. From week 14 (the end of March), the number of total national sales fell and continued on a downward trajectory. This is now beginning to change.

The latest data shows a slight improvement, with a noticeable slow down in the year-on-year decrease in sales from the week beginning the 13th of April. At the start of May (week beginning 4th of May), we can see a 30% decrease in sales volumes, which is an improvement from what we were seeing prior to this.

Transactions are decreasing at a reduced rate, which will likely result in a v-shaped recovery as sales numbers trend towards neutral.

Looking at sales numbers week on week, sales volumes decreased from week 12 onwards, with an accelerated decline from week 13 to week 16. The largest dip was in week 16, which recorded a week on week sales decline of -14.1%. This coincided with the Easter break, which historically records low market activity due to public holidays.

After this period we start to see a similar trend to what we see when we look at year-on-year figures. Transactions are decreasing at a reduced rate, which will likely result in a v-shaped recovery as sales numbers trend towards neutral. In week 19 (week beginning the 4th of May), the week on week sales decrease was only -3.0%. If the trend continues, this number will improve, especially since most states have now reinstated auctions and open-for-inspections.

Are states all behaving the same?

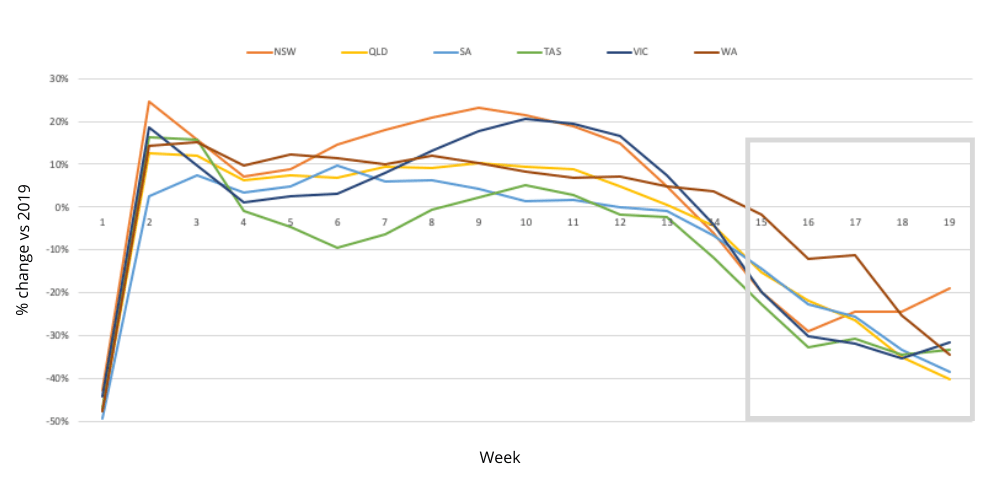

Last time we explored the data, all states were more or less following the same trend with declining transactions. Compared to last year, from week 15 (week beginning 6th April) up until week 19 (week beginning 4th May), there is an increase in declining transactions across all states other than New South Wales.

In week 16, sales in New South Wales were around 29% less than the same time last year. After week 16, the New South Wales market experiences a swift upper trajectory through to week 19, where transactions finished on 19% lower than the same week in 2019. This coincides with the New South Wales government announcing an easing of restrictions for the state. Other states in the week beginning th 4th of May recorded volume declines of around 35% less than the previous year.

Looking at week on week performance in 2020, by the 10th of May (end of week 19) there is a positive increase in sales in both New South Wales and Victoria compared to the week previous. New South Wales shows a positive increase of 3%, and Victoria records 1%.

Other states are trending in the same direction too, with the rate at which sales volumes were falling starting to get better week on week.

Regional Australia versus metropolitan Australia

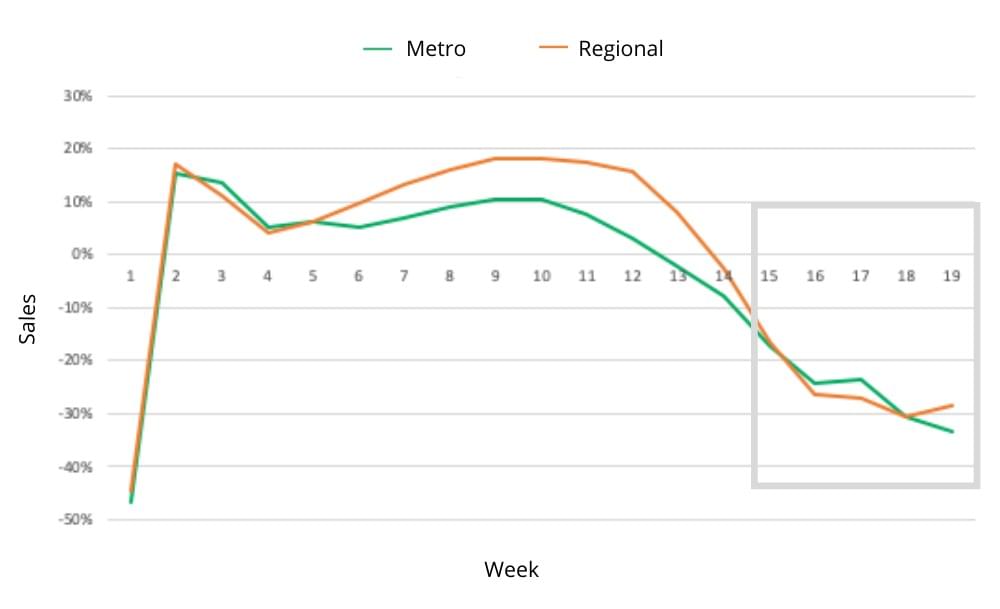

While we often tend to think of regional and metro markets behaving differently, in the current climate, they are behaving similarly, especially over the last five weeks.

In week 15, which is the beginning of April, the number of transactions in regional areas dropped by about 17% compared to the same time last year. By the 10th of May, which is the end of week 19, transaction volume had tumbled to 33% compared to the same time in 2019.

The measures put in place by the federal and state government have affected regional and metro markets in the same way.

We see the same pattern in metro areas, where in week 15 transactions were 17% lower compared to last year, and by the end of week 19, that worsens to 29% lower.

What this tells us is that in the case of Covid-19, the measures put in place by the federal and state government have affected regional and metro markets in the same way.

The only difference can be found if you look at transaction volumes for both regional and metro areas from a week-on-week perspective. In week 16, which is mid-April, transactions in metro areas fell faster than regional areas.

Both regional and metro areas are trending upwards towards neutral territory with week-on-week transactions improving. As it stands, metro areas are bouncing back at a faster rate.

Are properties taking longer to sell?

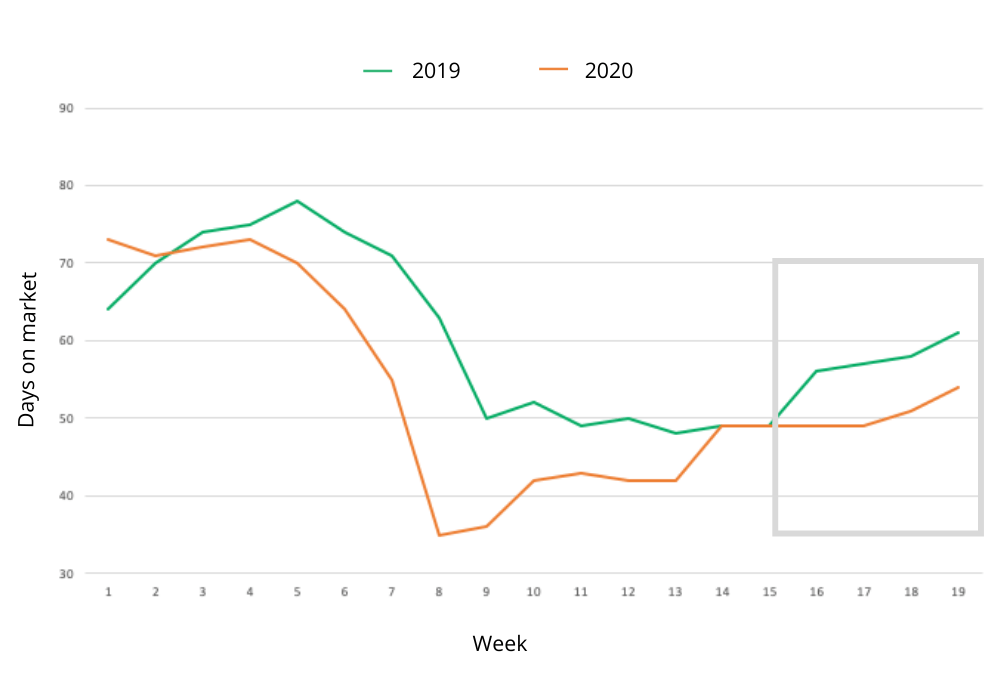

It’s a question sellers want an answer to. If you need to put your property on the market, will it actually sell? Let’s take a look at how national days on market have performed over the last 5 weeks.

Compared to 2019, between the 20th of April and the 10th of May, the time it takes to sell a property is actually faster in 2020. In this time period in 2020, properties took 54 days to sell compared to 61 days last year.

While the time it takes to sell a property is improving, it’s important to note that this may be due to the lower amount of stock on the market.

It’s also important to note that while this is the national trend, specific areas and suburbs may behave differently. We always recommend that you do your research. It’s helpful to speak to a local agent about how the market is performing in your area before making a decision.

Are properties selling faster in metro or regional areas?

The latest data shows us that in metro areas, the time it takes to sell a property is still faster compared to last year, even amidst a pandemic.

In regional areas, for the first time this year, we actually saw days on market improve, where by week 18, at the end of April, the time it takes to sell a property was the same as last year, and by week 19, starting from the 4th of May, time to sell was four days faster compared to 2019.

Are house prices holding steady?

Historically, housing prices have been relatively insulated in the face of economic shocks, while transactions have been more impacted.

This is the pattern we are seeing today. Considering all the ‘doomsday’ style media reporting, property prices are actually holding up quite well. From a pricing perspective, CoreLogic reported that by early May the combined capital city markets have only just begun to show mild value falls of less than half a percent over a month. This was led by Melbourne, where values were down about half a percent. This is good news for vendors, given the recent media headlines reporting possible house price falls of 30%. At this stage, it looks like rental prices are going to be more affected than property prices.

Mr McKibbin said, “Everybody seems to be talking the market down but the data doesn’t seem to want to support that.”

In a recent Real Estate Institute of NSW Facebook Live where CEO Timothy McKibbin, and President Ms Leanne Pilkington were discussing the state of the current market, Mr McKibbin said, “Everybody seems to be talking the market down but the data doesn’t seem to want to support that.”

According to Ms Pilkington, “People are trying to talk the market down, but what I’m hearing in the field [is] there is a lot of buyer interest, but it’s hard to get the vendors to put their properties on the market. That lack of supply when there is demand, we know, does not lead to a falling market,” she said.

Auction clearance rates have been on the rise too, with CoreLogic stating this is likely the result of recent relaxations in social distancing policies specific to housing. While actual auctions are lower than last year, CoreLogic expects that as restrictions continue to ease, we will see that number go up.

What does this mean for the future?

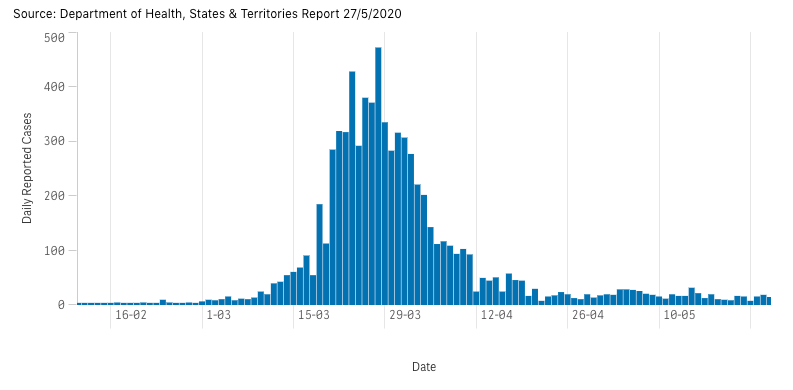

As we know, the faster the virus is contained, the faster the economy can return back to normal. New reported Covid-10 cases have slowed dramatically compared to even just one month ago, with 11 total cases being reported today at a national level. It’s impressive.

In addition, we have seen even more loosening of restrictions across the country. The number of people permitted at public and private gatherings has increased, and cafes, restaurants and pubs have opened across a number of states, with permission to serve a restricted number of patrons. Regional travel has also opened up in all states and territories, with travel restrictions only in place for remote communities in the Northern Territory.

It seems like we’re headed in the right direction, but does this mean the property market is too? It’s a little bit more complicated. While the easing of restrictions, namely on the real estate industry, has definitely had a positive impact, it may be awhile before the market bounces back to how it was just before Covid-19 made its impact.

There are plenty of factors that will impact consumer confidence and the housing market, including the rate of unemployment, whether the period of reprieve on mortgage repayments will continue, and whether the JobKeeper program will end on the 27 September 2020 as planned. If we experience a severe second wave of cases, all of these factors could be disastrous for the Australian economy.

It’s hard to say what will happen, given how unprecedented this pandemic is, and how uncertain the future is. And every analyst has their own opinion on what is going to happen moving forward. Let’s list out what some have recently told the ABC.

According to CoreLogic’s Head of Research Ms Eliza Owen, while transaction volumes, consumer sentiment and listings have all dropped, we are headed towards a new normal, as activity is starting to stabilise. In terms of property prices, she says, “over the next one to two years, we would expect that property prices will see a decline, probably of no more than 10 percent nationally.”

Mr Louis Christopher from SQM Research says, “It all rests with what’s going to happen with coronavirus, and I’m not a medical expert.”

He told the ABC that despite most forecasts predicting a fall in prices, this isn’t a 100% guarantee.

“Right now there’s actually no bargains. Vendors are holding their ground, that’s what the data is showing us. There might be bargains later in the year, we don’t know,” he says.

"With all the cuts in interest rates and quantitative easing, which is effectively money printing, we may well see dwelling price rises as a result of just those two factors,” he said.

According to Professor Steven Rowley from Curtin University’s School of Economics, Finance and Property, different areas will recover more quickly than others, and the areas that traditionally experience a stronger level of demand, due to good schools and so forth.

Timothy McKibbin from REINSW says that if the market is going to change, this will happen later down the track. So his advice is that if you’re a vendor thinking about putting your property on the market, he suggests you strongly consider coming on the market now.

What if you need to sell?

If you need to sell your property for whatever reason, it’s still entirely possible and sellers are still reporting fantastic results. You just need to understand that conditions are going to be a little bit weaker.

While transaction volumes are lower, there are still buyers out there, and lending rates are the lowest they’ve ever been. Our daily conversations with agents tell us (anecdotally) that well-presented properties that are priced reasonably are still selling.

To help you on your way, we’ve also created this helpful guide for selling during the Covid-19 crisis.