The market continues to cool in July as affordability issues peak

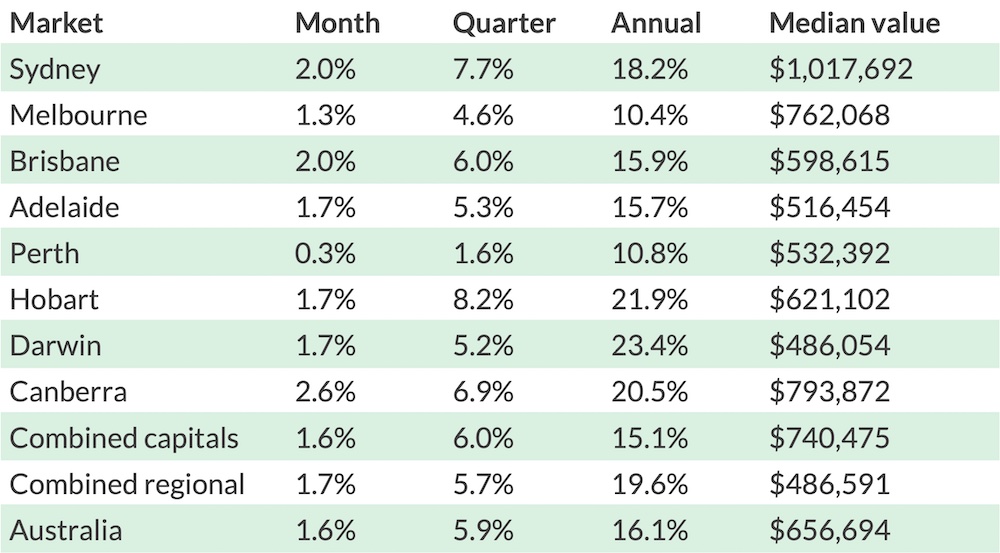

After a scorching first six months of the year, the Australian property boom has once again eased off the gas slightly in July, recording an increase in median property values of +1.6 per cent nationally, according to CoreLogic's latest Home Value Index report.

That's down from a monthly high of +2.8 per cent in March, suggesting a trend towards milder growth in the second half of 2021.

While interest rates remain at record lows, affordability (or the unaffordability of real estate, to be more direct) is beginning to price more buyers—first home buyers especially—out of the market.

It's far from the end of the growth cycle, though, with plenty more steady gains forecast over the next 18 months.

National property values: July 2021

| Median property value | Monthly change | |

| Houses | $695,800 | +1.8% |

| Units | $576,063 | +1.2% |

Although the rise in property prices was slightly more subdued in July, the +1.6 per cent national increase still means the Australian median dwelling value jumped up more than $11,000 to $656,694.

Tim Lawless, CoreLogic's research director, notes that "the +16.1 per cent lift in national housing values over the past year is the fastest pace of annual growth since February 2004, however the monthly growth rate has been trending lower since March this year."

Canberra continued its blinding run with a +2.6 per cent uptick for the month, making it the fastest-growing capital city in July.

A +2.0 per cent increase in Sydney well and truly nudged the locked-down Harbour City above the fabled $1 million high water mark, where the median home price now sits at $1,017,692.

Brisbane homes also jumped up by +2.0 per cent, while Adelaide, Hobart and Darwin all delivered above-average bumps of +1.7 per cent.

Melbourne, also dealing with its own lockdown, saw a +1.3 per cent boost to its home values, while Perth continued its sluggish run, turning in +0.3 per cent growth for the month.

Looking outside the capitals, regional markets closely mirrored their metropolitan counterparts.

Regional NSW had the biggest jump for the month at +2.0 per cent, while Tasmania, Queensland and Victoria all followed close behind with +1.8 per cent, +1.7 per cent and +1.5 per cent respectively.

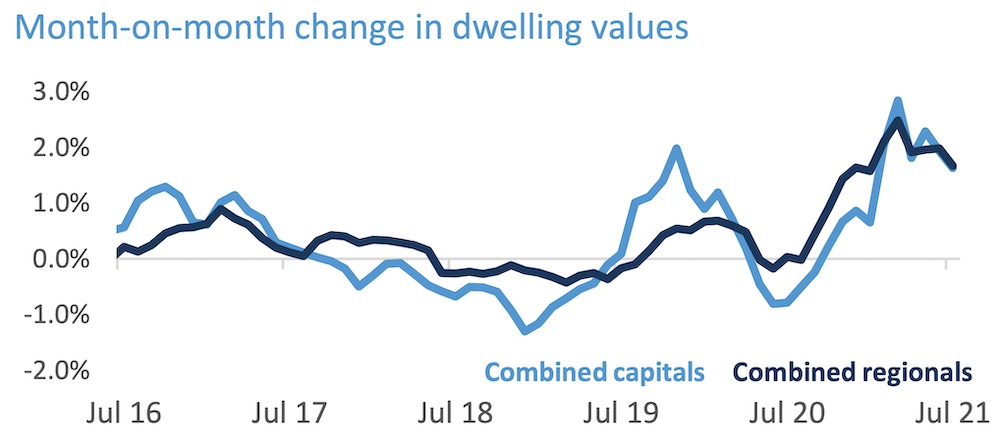

CoreLogic's report points out that, while regional markets were outpacing capital cities in the second half of 2020, that gap has now shrunk and the conditions in regional and metro markets are now evenly matched.

Affordability constraints are at the heart of the cooldown

With some cities surging more than +17 per cent in 2021 alone, buyers are experiencing pressures they never could have imagined during last year's downturn.

"With dwelling values rising more in a month than incomes are rising in a year, housing is moving out of reach for many members of the community," Mr Lawless explains.

He points out that a number of pandemic-related Government support schemes have expired, making that pressure even greater, although new assistance is being introduced as a result of the latest outbreak.

"Sydney is the most expensive capital city by some margin and it has also been the city where values have risen the most over the first seven months of the year," he says.

Listings remain low due to lockdowns, while sales are still well above average

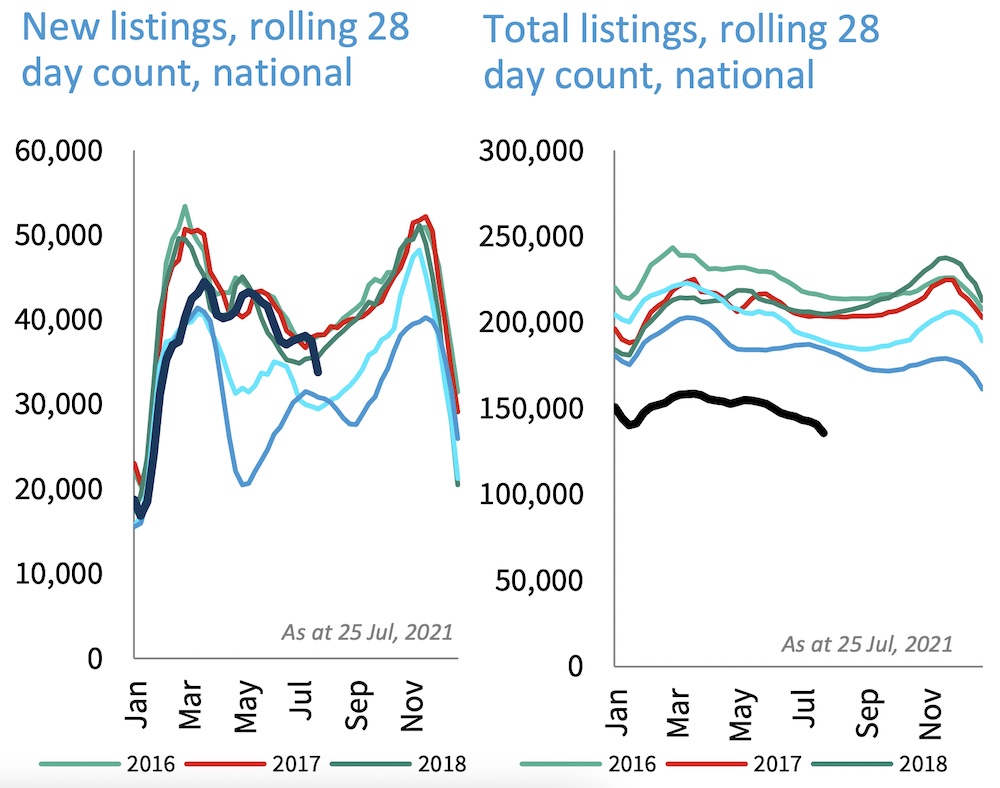

It's become a bit of a cliché to point out the imbalance between low stock on the market and the ravenous buyer appetite, but the data continue to show that that dynamic is largely unchanging.

"Demand is being stoked by record-low mortgage rates and the prospect that interest rates will remain low for an extended period of time," Mr Lawless says.

"Dwelling sales are tracking approximately +40 per cent above the five-year average while active listings remain about -26 per cent below the five-year average.

"The mismatch between demand and advertised supply remains a key factor placing upwards pressure on housing prices."

As a result of lockdowns, Sydney listings have plummeted -30 per cent since the end of June, with Melbourne not far behind on -27 per cent.

"With stock levels remaining tight, selling conditions have been skewed towards vendors," Mr Lawless explains.

"Auction clearance rates have remained in the low-to-mid 70 per cent range across the major auction markets through July and private treaty sales continue to record rapid selling times and low discounting rates."

"Worsening affordability is likely a key contributing factor in the slowdown here, along with the negative impact on consumer sentiment as the city moves through an extended lockdown period."

Houses are still substantially outperforming units

Another recurring feature of the monthly updates is the disparity between house and unit prices, with houses growing at more than twice the rate of units on the national level.

Detached homes have recorded an +18.4 increase in the 12 months to now, compared to just +8.7 per cent for units, with Hobart being the only exception to the outpacing.

"Potentially the slightly stronger conditions across Hobart’s unit sector reflects greater demand from downsizers and empty nesters, or it could be attributed to worsening affordability constraints, diverting demand into the more affordable unit sector where median values are around $156,000 lower than houses," Mr Lawless says.

It's a very different story in every other city. In Adelaide, houses are up +12.0 per cent for the year so far, while units have managed to increase by only +2.9 per cent.

Buyers continue to look to upgrade and move into more spacious properties as the pandemic means people are spending more time at home and, often, working remotely.

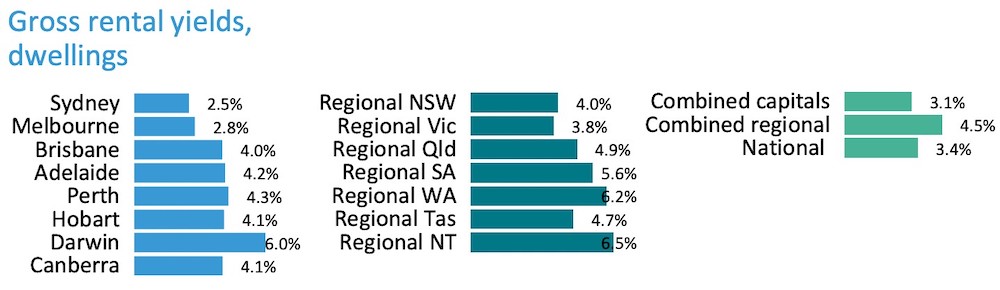

Rental markets around the country are in varying states of recovery

While it's been nothing but upwards for most residential sale markets this year, the situation with rentals in Australia is still more of a mixed bag.

Nationally, rents are up +7.7 per cent annually, the highest rate of increase seen since 2008.

Mr Lawless explains that "rental conditions across Darwin and Perth are the tightest amongst the capitals reflecting low vacancy rates and high rental demand.

"At the other end of the spectrum are the apartment sectors of Melbourne and Sydney, where rental conditions have been substantially looser," he says, although rents are now stabilising in both cities.

Capital gains, along with those improving rental returns, are continuing to entice investors in both cities.

"Considering yields outside of Sydney and Melbourne are high relative to mortgage rates, and housing values are expected to rise further, we are likely to see investment activity continue to lift," Mr Lawless adds.

What comes next for the Australian property market?

Even though there looks to be an overall easing of growth, CoreLogic still asserts the property market has a strong outlook.

The report notes that the average monthly increase in dwelling values over the past ten years is +0.4 per cent, so the current level of growth is still far beyond the norm.

Still, affordability constraints, along with an expected increase in listings later in the year, should serve to temper the historic boom.

Sydney's extended lockdown in particular is expected to cause a lasting disruption, and it's widely predicted that the Reserve Bank of Australia will have to raise the cash rate earlier than their previously announced 2024 target, meaning mortgage rate climbs could be on the horizon.

AMP's chief economist Shane Oliver doesn't see things changing drastically in the shorter term, though, suggesting that the current low-interest rate environment and FOMO frenzy aren't going to vanish overnight.

"None of these factors look likely to change over the rest of 2021, and we expect that house prices will rise by another 10 to 15 per cent out to the end of next year," he says.

"But house prices can’t increase at this rate indefinitely and history shows they sometimes go down—just ask anyone who bought into the Perth market at the top of the mining construction boom."