This is how Covid-19 actually impacted the property market in 2020

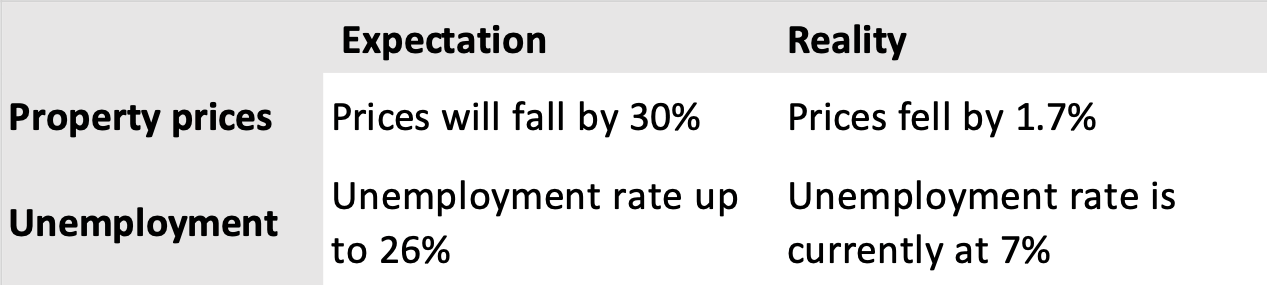

Earlier in the year, major bank economists presented a gloomy outlook on property prices predicting that Australian home values would drop by 10 to even 30 per cent in a worst-case scenario.

Despite restrictions and border closures, According to CoreLogic’s National Home Value Index, property prices proved to be extremely resilient, declining a mere -1.7 per cent between March and October.

Prices are also bouncing back faster than expected with the November CoreLogic Home Value Index revealing national values are up +0.8 per cent, marking a second consecutive month of rises.

Tim Lawless, CoreLogic Head of Research said that if the current growth trend persists, we are likely to see national home values surpass pre-covid levels in early 2021.

“If housing values continue to rise at the current pace we could see a recovery from the COVID downturn as early as January or February next year,” he said.

The economy has also turned a corner with Australia’s gross domestic product (GDP) growing for the first since March this year.

The latest Australian Bureau of Statistics (ABS) data shows that the economy is officially lifted out of a technical recession, rising +3.3. per cent in the September quarter.

With consumer sentiment at a ten-year high and auction activity extremely strong, it is no surprise that buyers are out in full swing, bolstered by first home buyer grants and incentives, as well as record-low interest rates.

ABS data shows that home loans also reached a record high in October, surging more than 30 per cent higher than last year.

Impact of Covid-19 on the Australian property market: Expectation vs Reality

Here’s why the housing market didn’t crash

Mild property declines during the recession can be credited to many different factors. The first being low interest rates and Government incentives to encourage buyers to enter into the market.

When the Reserve Bank of Australia reduced the official cash rate target to a historic low of 0.1 per cent, the low cost of borrowing money meant that for some, it would be cheaper to purchase a property than to rent.

Other government schemes such as the $25,000 HomeBuilder program and First Home Loan Deposit Scheme (FHLDS) also worked to stimulate demand for property.

Supply on the other hand was lacking, with SQM Research figures showing that in April, there were 60 per cent fewer homeowners listing their properties for sale compared to March. Many sellers during this time delayed putting their property on the market due to economic uncertainty and unprecedented market conditions.

"The latest ABS data show the unemployment rate currently sits at 7.0 per cent - lower than the double-digits anticipated earlier in the year by The Grattan Institute."

Mortgage repayment deferrals also helped to avoid a glut of distressed sales from hitting the market. This may have contributed to the low stock throughout the year, helping to insulate property values.

Another factor that helped cushion price reductions was the fact that this downturn disproportionately impacted young Australians who were less likely to have mortgage debt.

Australians working in the food and accommodation and arts and recreation sectors were hit the hardest with ABS figures showing that between March and April, 600,000 Australian workers lost their jobs with almost one in three workers aged between 18 to 24.

While the pandemic certainly did have a devastating effect on Australians, the latest Australian Bureau of Statistics employment statistics show the unemployment rate currently sits at 7.0 per cent - lower than the double-digits anticipated earlier in the year by The Grattan Institute, which estimated between 14 and 26 per cent of Australians could be out of work due to Covid-19.

The November statement on Monetary Policy by the Reserve Bank of Australia reveals that the employment rate is expected to peak a little below 8 per cent around the end of the year and is expected to decline gradually to just above 6 per cent by the end of 2022.

Fiscal support from the Government through the JobKeeper and JobSeeker schemes have been crucial in keeping unemployment down, providing financial aid for those who had been retrenched or made redundant.

With monetary support from the Government set to wind back and mortgage deferral payments set to expire, there was much fear and concern over a “September cliff” which anticipated property prices to plunge.

During this time, banks and statutory authorities responded by extending repayment deferrals where needed, resulting in minimal distressed sales.

This had a flow-on effect on the property market with September actually marking a striking turn in housing market sentiment with six of the eight capital cities recording a rise in home values over the month.

In terms of mortgage deferrals, in the latest Commonwealth Bank November update on temporary loan repayment data, an encouraging 73 per cent of customers have returned to making full payments while 23 per cent have extended their deferral period.

“It’s a good time to buy”

Reserve Bank governor Philip Lowe said in a parliamentary panel on 2nd December that “it is a good time to buy” for Australian first home buyers due to current conditions.

When asked if young Australians should take advantage of current interest rates and purchase a first home, Mr Lowe said he did not like giving financial advice to people, but does think it’s a good time to buy.

“Interest rates are low and they’re going to stay low.

“There are very, very large government incentives for first home buyers, and housing prices across the country are no higher than they were three years ago.

“So for a first home buyer with income security, I think it is a good time to buy,” he said.

Mr Lowe has also backed the NSW Government's proposal to move away from stamp duty and towards an annual tax saying it will help with Australians being able to move around more freely.

“Every time you switch housing, you pay a tax. If you stay in your place, you don’t pay the tax. So it’s a tax on mobility.

“In a country that’s inherently mobile, and where we want people to be flexible, to be able to move around in response to jobs, opportunities and for family reasons, we don’t want to put taxes on mobility. So I think it’s the right thing to do,” he said.

Positive outlook for 2021

Most economists are now predicting a strong year ahead with SQM Director, Louis Christopher now expecting prices to rise between 7 to 11 per cent in Sydney and by 5 to 9 percent nationally in a “base scenario”.

As outlined in his Housing Boom and Bust Report 2021, this forecast assumes ongoing fiscal support from the Federal Government and Reserve Bank as well as a progressive rollout of a Covid-19 vaccine.

After previously expecting a 10 per cent reduction in national prices between April 2020 and June 2021, ANZ Chief Economist Bill Evans has now lowered the expected decline to 5 per cent followed by a 15 per cent surge over the next two years.

“We now expect many capital city markets to be more resilient with a national fall of 5% between April and June next year, distributed between: Melbourne (–12%); Sydney (–5%); Brisbane (–2%); Perth (flat); and Adelaide (2%).

“Of most importance is that we are much more optimistic about the pace of price appreciation over the following two years with a total expected increase of around 15%,” he said.