Women on average spend 2 years longer to save for a house due to gender pay gap

Saving for a house is tough enough given the astronomical price of Aussie property, but did you know that women will on average take 2 years longer to get their foot on the property ladder?

That's thanks to the gender pay gap - the difference between women's and men's average weekly full-time earnings. Despite advances made in narrowing the gap, there is clearly a lot to be done - with women taking home about 14.1% less than men, or around $240 less a week.

The real world implications of this mean Aussie women not only take a lot longer to save for a home, but they are also restricted by what they can afford. The gap also varies by location, and here we identify the best and worst states to be a female homebuyer.

Let's start by looking at the concept of housing affordability and what median house prices are across the country.

Housing affordability and median house prices

Housing affordability is calculated by analysing how much of a household's income is spent servicing a mortgage or paying rent; or calculating the capacity of a household to maintain an acceptable standard of living after housing costs are paid.

According to the Organisation for Economic Co-operation and Development (OECD) housing affordability in Australia has actually declined since the early 1980s, which has made it harder for first home buyers - and especially single women - to afford a home.

It's useful to look at median house prices (as of Feb 2019) as these ultimately determine how much you need to save toward a deposit - currently 20% of a property's value. The median price is the midpoint of all the properties sold over a given timeframe in an area.

In NSW - the most expensive state - the median house price is $650,000, so you would need a deposit of $130,000. Contrast this with Tasmania where the median is $350,000, which would require a deposit of $70,000 based on the same criteria. The median across Queensland is currently in the region of $489,000, so lenders would be looking for $97,800 to secure a mortgage.

But how real is the gender wage gap?

Is the gender wage gap real?

The gender wage gap is very real!

And if you thought we have come a long way, think again! The wage gap has on average only closed by 2.42% compared to 25 years ago. The Australian Bureau of Standards (ABS) and Workplace Gender Equality Agency (WGEA) data shows that, a quarter of a century later, the gender pay gap still favours, "full-time working men over full-time working women in every industry and occupational category in Australia".

WGEA data (2017/18) - based on full time employment - shows that:

- Men earn $25,717 or 21.3% more on average a year more than women, based on total remuneration

- Men earn $15,457 or 16.2% more on average more than women, based on base salary

"The sector with the most pronounced gender pay gap is the financial and insurance services industry, where men make on average 26.9% more than women"

The sector with the most pronounced gap is the financial and insurance services industry, where the average difference between men and women's earnings is 26.9%.

When it comes to comparing the private and public sectors, the gender pay gap in the public sector (10.4%) is lower than in the private sector (17.7%).

The public administration industry has the lowest gender pay gap (5.1%), while retail also scores respectably (5.2%) - though the ultimate goal is obviously equal pay!

Now let's look at the geographical disparity of the gender gap - it could make you consider a move interstate.

Best and worst states to be a female homebuyer

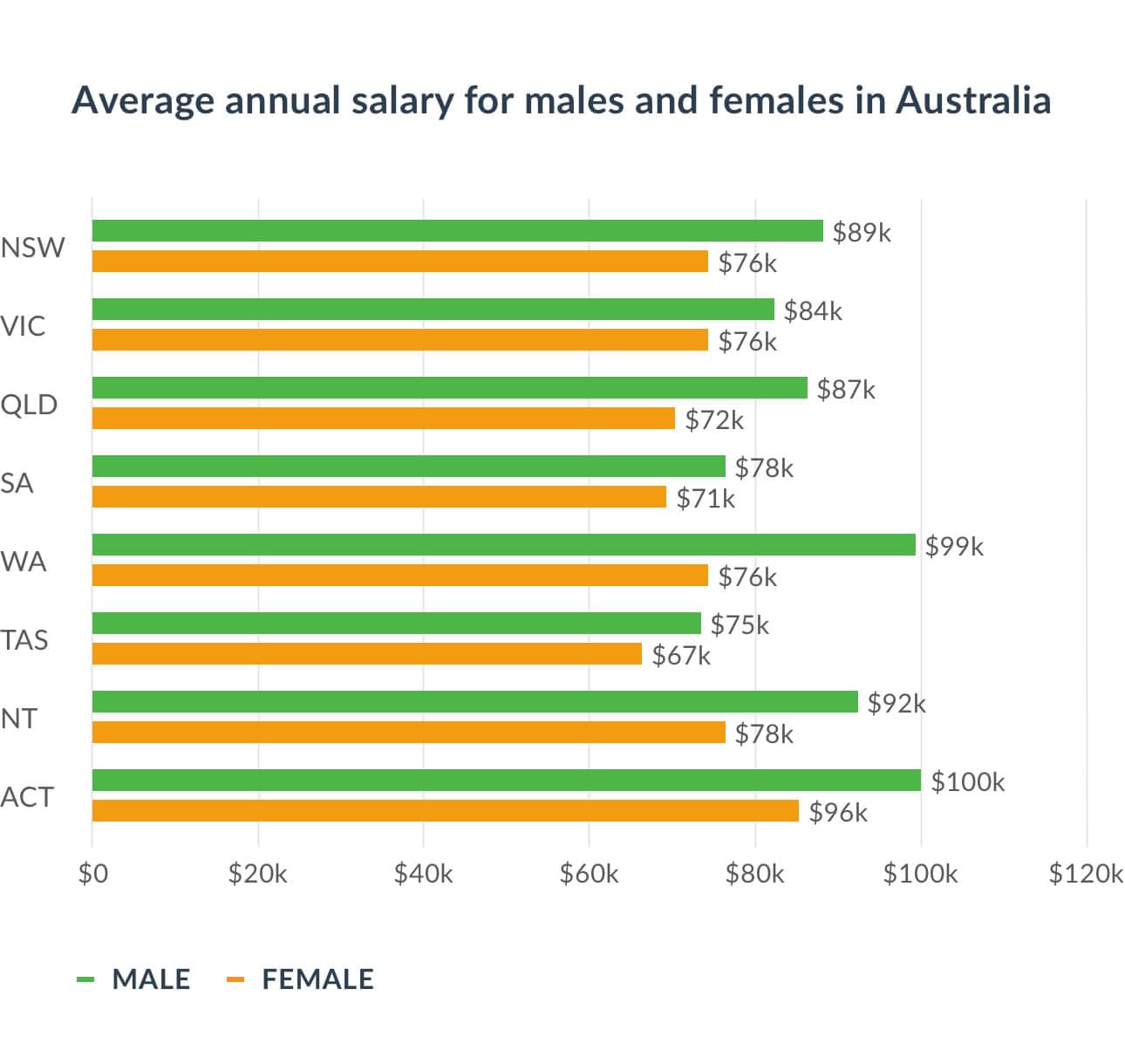

The smallest wage gap is in Victoria, where the average annual income for men is $84,125 and women $76,268 - meaning males make just 10.3% more. Give yourself a pat on the back Victoria, as you are the only state where this metric has got significantly better. Males in Vic made a whopping 20.44% more than women 25 years ago.

The wooden spoon goes to WA, which has the largest gender wage gap. The average annual income for males ($99,465) is 30% more than what females earn ($76,518). This metric is actually worse than it was 25 years ago when males were making 26.17% more - boo WA!

"The smallest wage gap is in Victoria (10.3%) while the wooden spoon goes to WA (30%)"

Now time for the nitty gritty - how long it takes men and women to save for that all important deposit, assuming you could only put aside 10% of your income.

How long it takes for women and men to save for a deposit

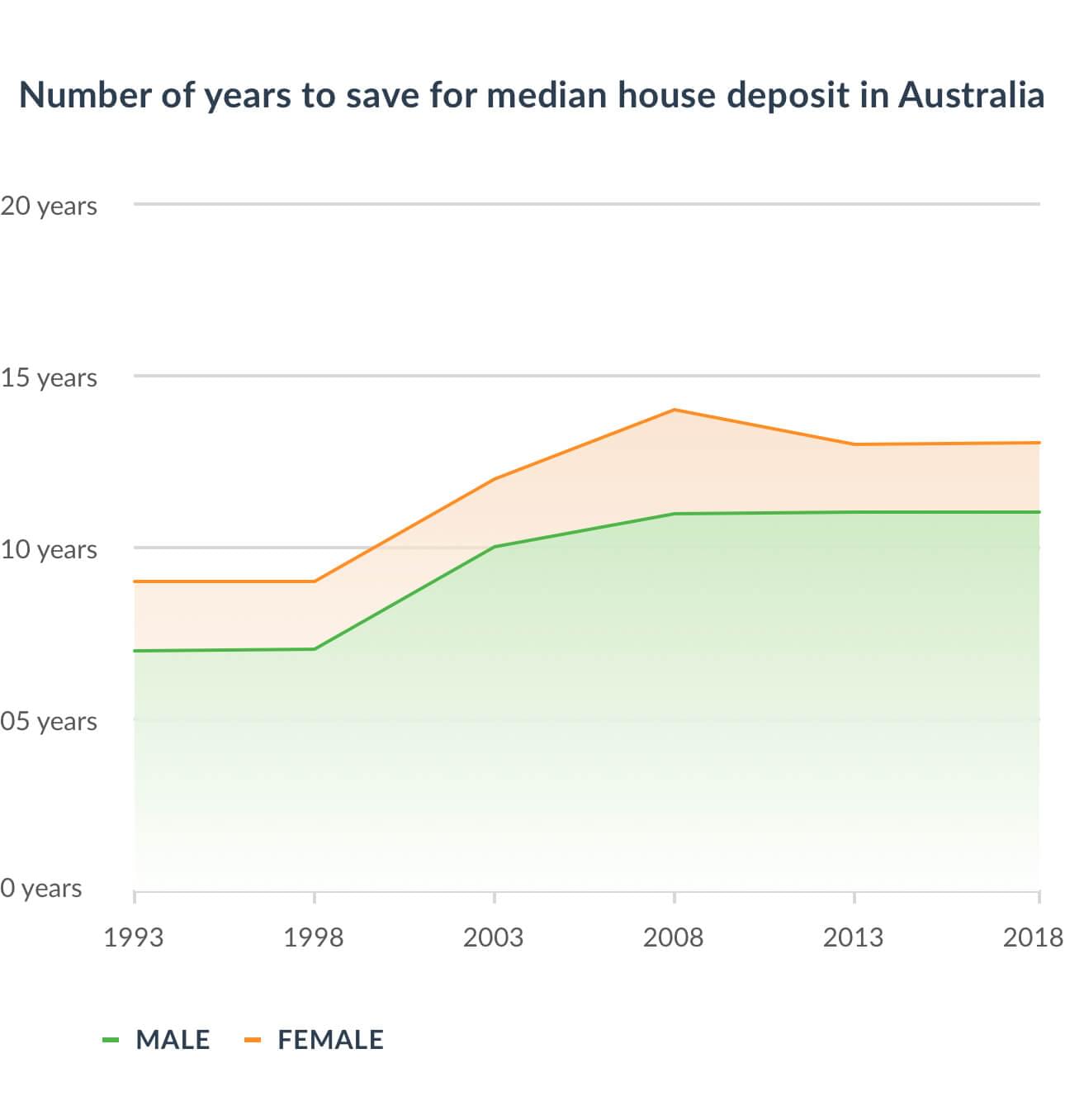

On a national basis it would take a man on average 11 years and 9 months to save for a deposit. This stretches out to 13 years and 9 months for a woman. This means that the gender pay gap penalty for women is on average 2 years longer to save for a deposit - remembering that they make around $12,469 less a year.

"The gender pay gap penalty for Australian women is on average 2 years longer to save for a deposit"

Even in Victoria where the wage gap is smaller, it would take females an extra year and a half. This is based on purchasing a $605k median house with a $121k deposit. In WA, the timeframe is 2 years and 9 months, based on a $453k median house and a $90.6k deposit.

Read: Cheapest suburbs to buy and rent in Melbourne

What does the future hold for gender equality?

The good news is that our government is serious about tackling gender equality.

For a start, there is the Workplace Gender Equality Act 2012, which "aims to improve and promote equality for both women and men in the workplace". This includes, "equal remuneration between women and men in employment and in the workplace". The Act also "requires various employers to lodge reports - for example, relating to equal remuneration between women and men".

Then there is also the Workplace Gender Equality Agency (WGEA) - a government body whose sole role is, "promoting and improving gender equality in Australian workplaces".

And even though Australia's national gender pay gap is 14.1% - a record low - we still have some way to go to redress this imbalance and give women an equal chance of becoming homeowners.