Two-thirds of Australian sellers believe property prices will continue to rise

At OpenAgent, we speak to thousands of home sellers from all around Australia every month.

As part of those conversations, we find out whether those sellers expect property prices to rise in the next six months as part of our ongoing consumer sentiment survey.

Our survey results show that seller sentiment has been restored back to healthy levels over the past 12 months, right in time for a confident spring selling season.

Key takeaways:

- Seller sentiment has recovered from an August 2022 low to levels seen before the interest rate hiking cycle began.

- Sentiment is strongest in Perth and Adelaide where prices are hitting new all-time highs.

- Confidence is elevated in metro areas, though regional sellers' outlook is also improving.

- Owner-occupiers are exhibiting more positive sentiment than investors.

Optimism has recovered in every state and city

Back in August 2022, OpenAgent's Consumer Sentiment Index hit the lowest point since the start of the pandemic as interest rate pressures mounted and the wider property market downturn set in.

While sentiment hasn't returned to the heights of the 2021 boom, the return of national price growth has seen optimism bounce back in spite of this year's interest rate hikes.

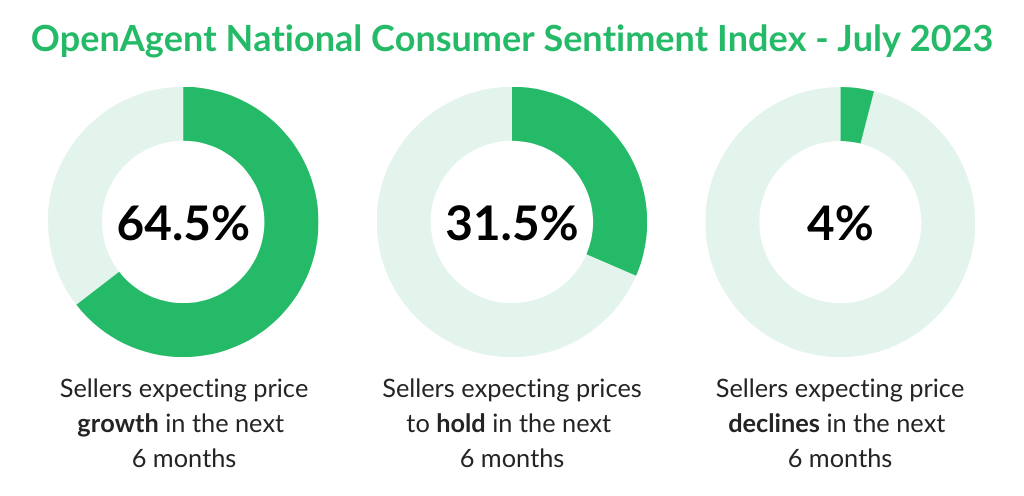

As of July 2023, close to two-thirds of Australian sellers believe that property prices will continue to rise over the next six months.

Less than one-third think prices will remain flat over the same period, while just 4 per cent expect home values to fall.

The lift in sentiment has coincided with a long-awaited increase in listings.

In July, CoreLogic reported that national new listings rose above the five-year average for the first time since September 2022, suggesting that sellers are finally more confident about returning to the market and capitalising on recent price gains.

While rising, sentiment is mixed between the capitals

Throughout the 2021 boom, consumer sentiment plotted a nearly uniform path between the major capital cities, hitting record highs for OpenAgent's index.

It's a bit more of a mixed bag mid-way through 2023 with more disparity between the performance of different city markets.

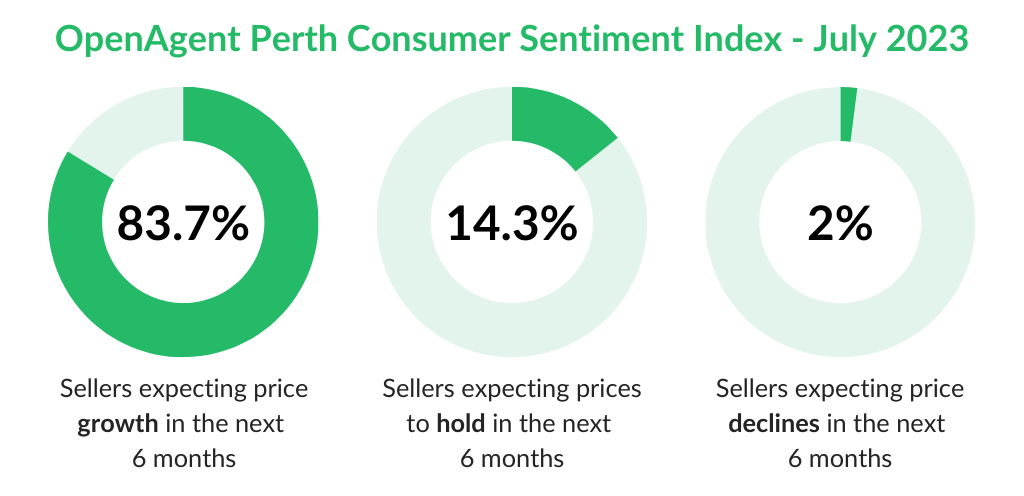

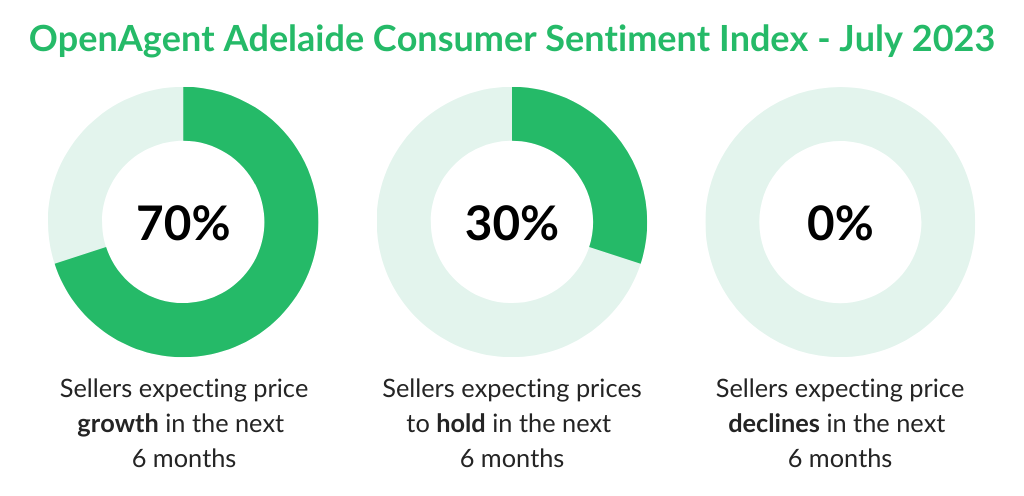

Breaking down current sentiment, Perth and Adelaide — two cities still achieving new all-time-high prices each month — are leading the pack.

A huge majority of Perth sellers see prices rising over the coming months, while just 2 per cent foresee price falls. More than two-thirds of Adelaide sellers also have a positive outlook.

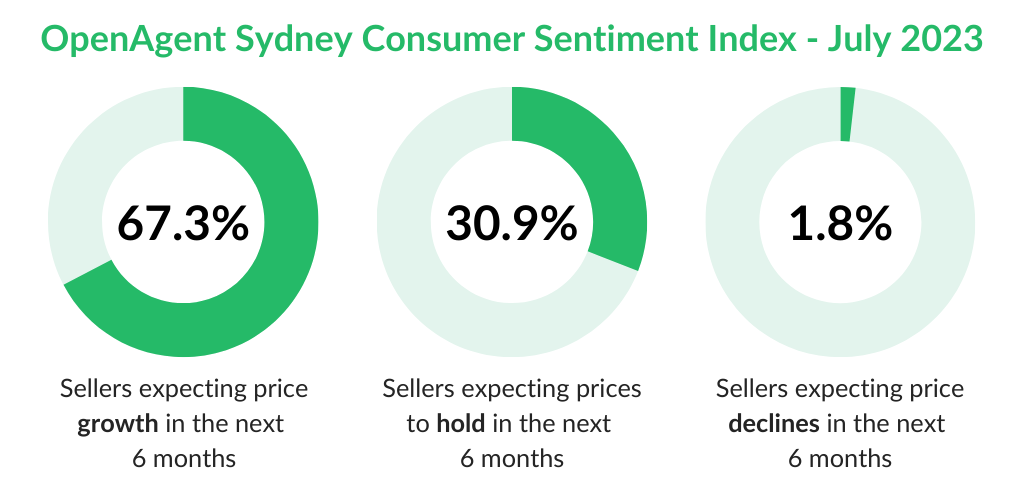

Sydney is third in line after a substantial confidence boost from January 2023 as prices have risen faster than any other city.

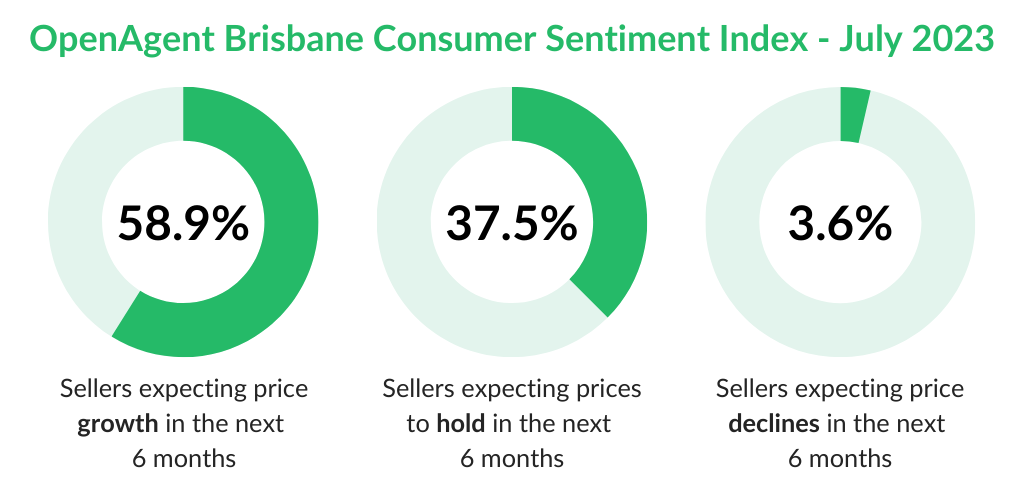

Brisbane sits a little lower, with a larger segment of sellers feeling that prices will level out over the rest of the year despite such strong recent gains.

The majority of sellers in Melbourne do see further price increases up ahead. However, Melbourne's slower pace of growth over recent months has meant a larger portion believes a correction could be on the horizon.

Comparing metro vs regional and investors vs owner-occupiers

Looking at different segments of the Consumser Sentiment Index data also tells some interesting stories about how Australians are feeling about the current market.

So far in 2023, regional areas have been broadly underperforming when compared to their capital city counterparts.

Despite this, outlooks between the two segments are surprisingly similar.

As of July 2023, the proportion of sellers expecting price growth within the next six months was 65.8 per cent for metro and 61.6 per cent for regional areas. Clearly, there is still some quiet confidence about the market outside of the capital cities.

Since OpenAgent's Consumer Sentiment Index began, investors have traditionally taken a more conservative view of the future of the market.

While that has remained the case throughout 2023, there has been a sharp uptick in investor confidence since March.

Despite many investors opting to sell up in the current high-rate environment, 63.5 per cent still believe prices will rise over the coming six months. That nearly matches 63.8 per cent of owner-occupiers.

Who's going to get it right?

The Australian property market has been plagued by uncertainty since early 2022 when sharply rising inflation sounded the alarm.

Now that the risk of further interest rate hikes appears to be minimal, though, many leading economists are seeing stronger prospects for further price growth around the country.

Westpac recently revised its Australian property price forecast to an elevated +7 per cent over 2023 and a further +4 per cent for 2024.

Matthew Hassan, Westpac's Senior Economist, said "previously, we had expected further interest rate rises and a material weakening in the economy to drive a significant loss of momentum for housing near term. That outlook now looks less challenging."

There are, of course, markets within markets, and every suburb is on its own unique path. This spring selling season will be an interesting one as we wait to see how any significant uplift in listings tests the depth of the buyer pool out there.