OpenAgent Consumer Sentiment Report - 2023 Q4

Here at OpenAgent, we know the importance of up-to-date market insights. As Australia's largest real estate comparison and referral platform, we speak to thousands of homeowners on the hunt for the right real estate agent to sell their home.

We're in a unique position to capture the market perspectives of sellers, one of the most important groups in the real estate ecosystem. We hope you enjoy this report, and we look forward to delivering many unique insights in the quarters to come.

Sincerely yours, Zoe & Marta, Co-Founders of OpenAgent

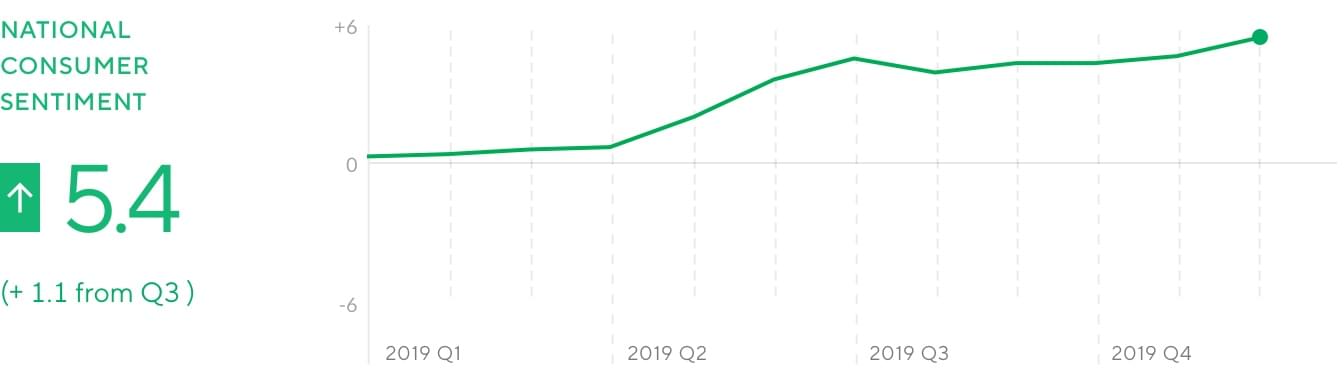

National consumer sentiment higher than last peak

In Q4 2019, consumer sentiment in Australia grew significantly compared to the relatively sluggish growth during Q3 2019. Though optimism increased considerably between Q2 and Q3 2019, no significant changes were observed throughout Q3 2019 itself.

"In Q4, national sentiment moved to a record breaking +5.4 in December. About 80% of vendors believed prices would go up in the next six months"

In Q4 2019, sentiment started at +4.3 in October and moved to a record-breaking +5.4 in December. About 80% of vendors believed prices would go up in the next six months, only 6% believed they would go down and the remaining believed they would stay the same. This value is even higher than it was during the last housing value index peak in October 2017.

These high expectations for price growth were likely to be driven by the strong dwelling values that were observed in October and November.

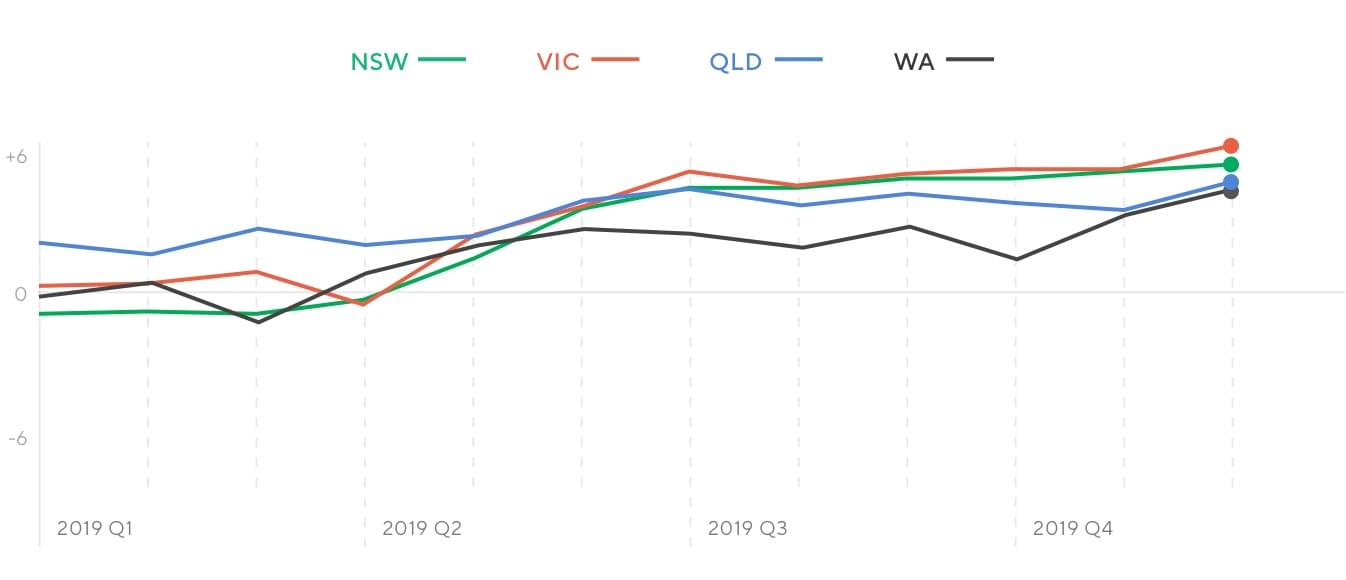

State consumer sentiment increasing across Australia

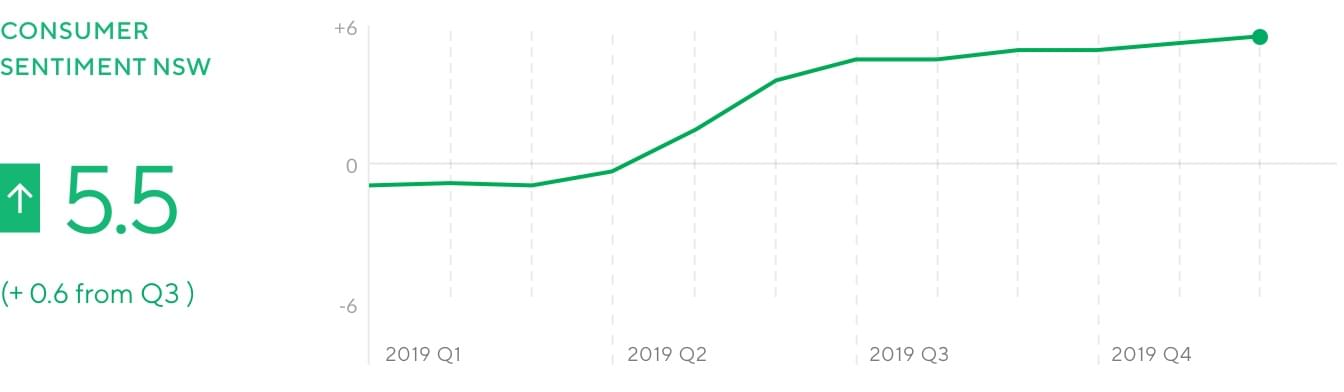

NSW sentiment steadily growing since election

From September to October, consumer sentiment in NSW remained at +4.9. It then moved to +5.2 in November and ended the quarter at +5.5 in December. Though the month-on-month increases were relatively small, these increments have made NSW the only state that hasn't seen a single decrease in sentiment since the election in May.

In December 2019, 82% of vendors from NSW said they believed prices would go up within the next six months, another 12% believed they would stay the same and only 6% believed prices would go down.

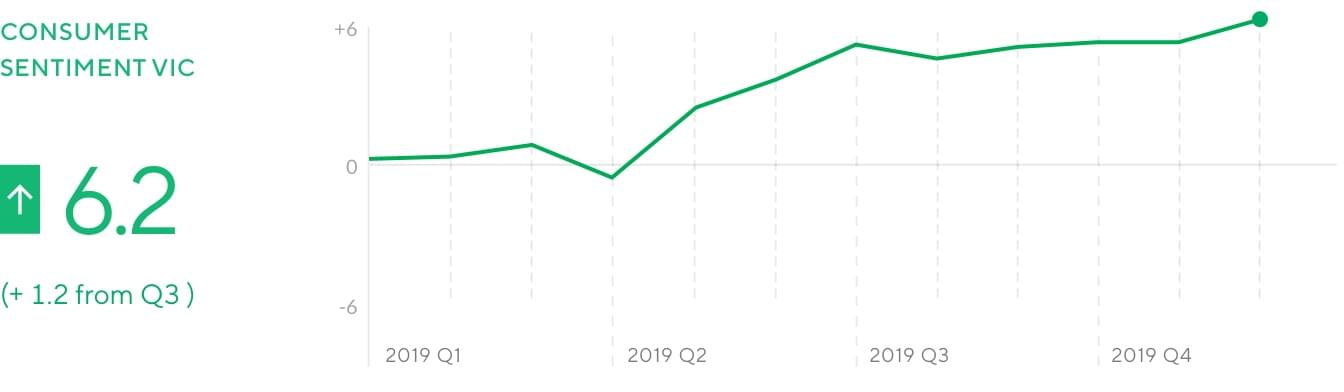

VIC sentiment highest in the nation

Victoria showed similar signs of growth at the beginning of the quarter, with a small increase from +5.0 in September to +5.2 in October. There was no change through to November, however, a massive spike to +6.2 was recorded in December, giving Victoria the highest sentiment across all other states for four consecutive months.

A massive 85% of Victorian home sellers in December believed prices would go up in the next six months. In comparison, less than 4% believed prices would go down and the remaining 12% believed prices would remain around the same.

"Victoria has had the highest sentiment compared to other states for a consecutive four months."

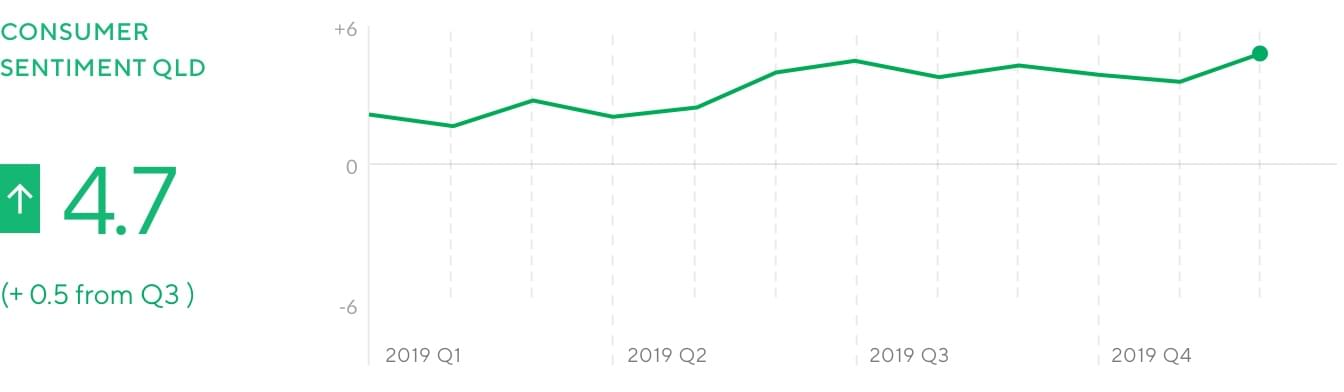

QLD sentiment remains similar

From the end of Q3 2019 to the end of Q4 2019, sentiment in QLD only increased by 0.5 points from +4.2 in September to +4.7 in December. During this time, sentiment was seen fluctuating. In October, it decreased to +3.8 and then further decreased to +3.5 in November before picking up again to +4.7 in December.

Though not as optimistic as vendors in NSW and Victoria, 74% of QLD vendors in December still said they believed prices would go up. Another 19% said they believed prices would stay the same and only 7% said they believed prices would go down in the next six months.

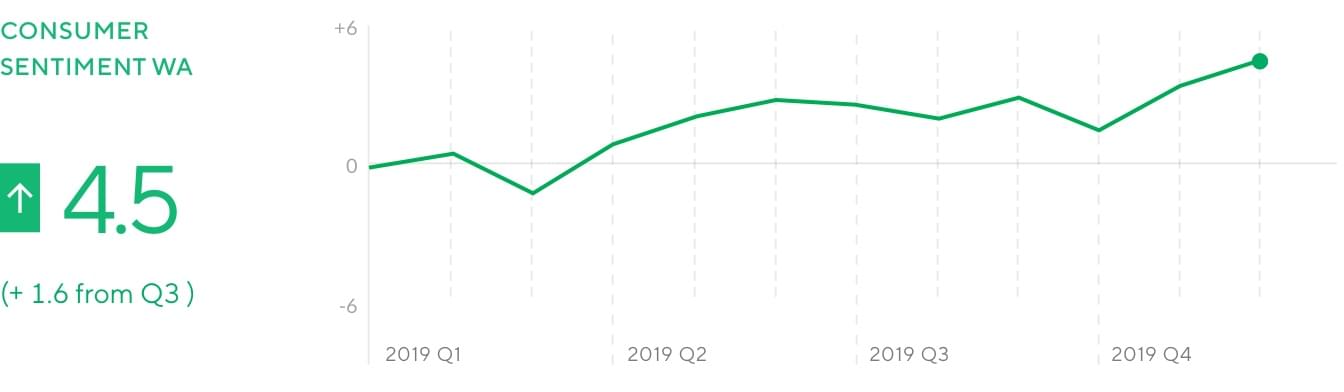

WA sentiment finally picking up the heat

Unlike other states, levels of optimism in WA didn't see the same substantial boost after the election results. However, sentiment is finally on the rise. During Q3 2019, the index sat between +2 and +3. At the end of December, it increased significantly to +4.5, suggesting that vendors are now more confident that prices will be going up in the next six months.

SA sentiment grows to second-highest in the nation

At the end of Q3 2019, sentiment in SA was on par with WA at the low index of +2.9. However, optimism picked up significantly in Q4 2019. In December, sentiment sat at +6.0, only 0.2 points below Victoria and 0.5 points higher than NSW, making SA the state with the second-highest sentiment in Australia.

"In Q4, sentiment in South Australia skyrocketed from +2.9 to +6.0 - only 0.2 points below the state with the highest sentiment in the nation."

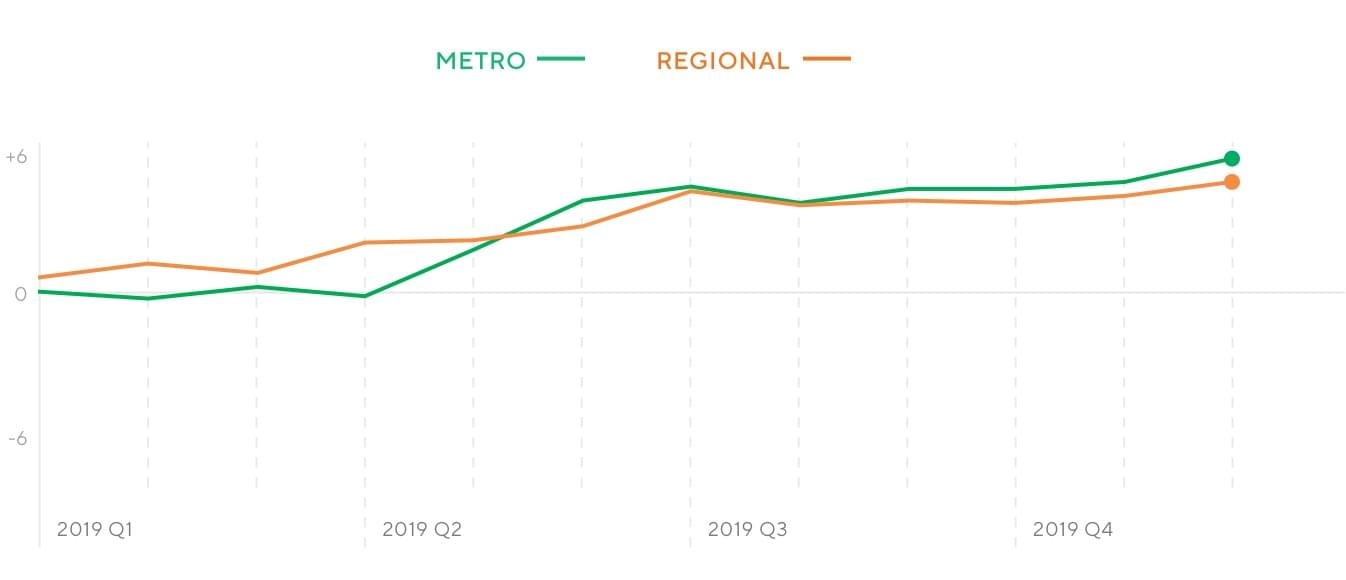

Metro and regional sentiment

Sentiment in metro areas is slightly higher than the national average, sitting at +5.8 for the end of Q4 2019. Sentiment in regional areas is more conservative with a sentiment of +4.8 for the end of the quarter. A higher proportion of vendors in regional areas compared to metro areas believe house prices will stay the same in the next six months.

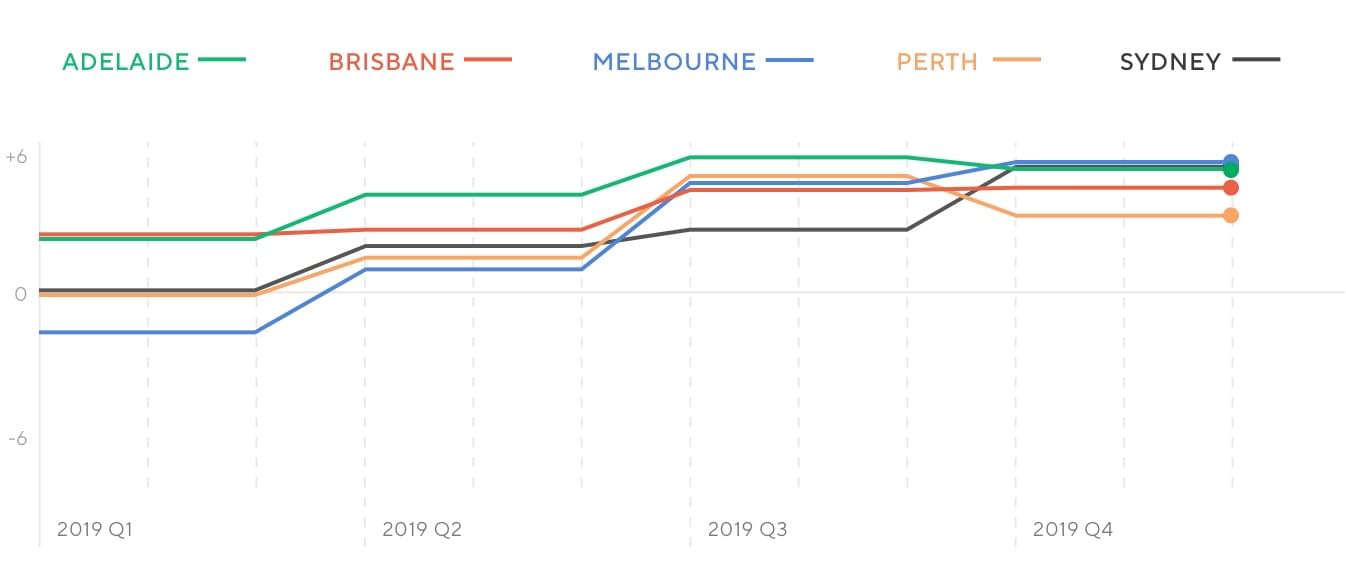

Capital city sentiment resemble respective states

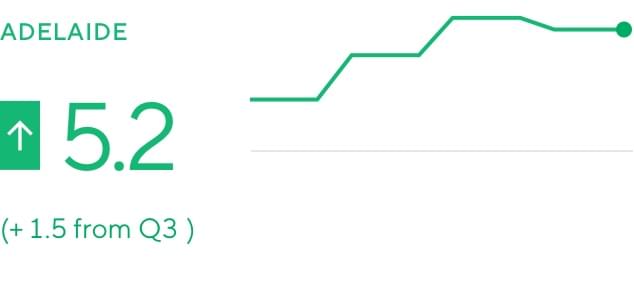

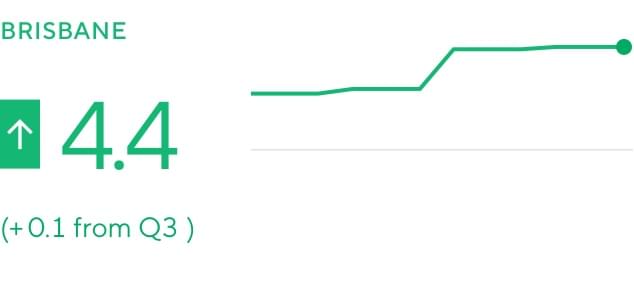

Consumer sentiment trends for capital cities resemble that of their respective states. The highest indexes can be seen in Melbourne with an index of +5.5, Sydney with an index of +5.3 and Adelaide with an index of +5.2. Brisbane has only had a marginal increase from +4.3 in Q3 2019 to +4.4 in Q4 2019.

"In Q4, consumer sentiment trends for capital cities resemble that of their respective states"

Signs of recovery are being seen in Perth with sentiment going from +2.6 in Q3 2019 to +3.2 in Q4 2019. Though +3.2 still signals a lower level of optimism in comparison to the other capital cities, this is the highest index Perth has had in the history of the Consumer Sentiment Index.

Investor and owner-occupier sentiment at record-breaking highs

Investor sentiment remained flat at +3.7 from September to November. However, in December, a drastic increase to +5.3 was observed. Investors likely held back their expectations on prices until there were more clear signs of growth in the market. Sentiment in December for investors was higher than it was during the 2017 property boom.

Owner-occupiers are also hopeful that prices will be increasing in the next six months, with sentiment increasing to +5.7 in December, the highest it's been since the Consumer Sentiment Index started.

Highlight: Sydney regions looking positive

Our index takes a more in-depth look into Sydney, Greater Sydney and its surrounding regions of the Illawarra and the Central Coast/Newcastle.

East Sydney and Newcastle have continued to have particularly strong levels of sentiment compared to other regions in and around Sydney. In Q4 2019, sentiment in both East Sydney and Newcastle sat at +5.6.

Following closely behind are Greater Western Sydney at +5.5 and South Sydney at +5.3. These regions had the lowest sentiment in Q3 2019. However, after having the highest growth between Q3 2019 and Q4 2019, they are now the regions with the third and fourth highest sentiment in and around Sydney.

Sentiment for Q4 2019 in Western Sydney was +5.2, in North Sydney was +5.0, in the rest of NSW was +4.7, and finally in Illawarra was +4.4. The Illawarra region was the only region that had a decrease in sentiment from Q3 2019 to Q4 2019.

How does the Consumer Sentiment Index work?

To build the Consumer Sentiment Index, we ask our vendors the following question:

Where do you expect home prices to be in your area in six months' time?

Vendors then rank their answer on a 5 tier scale, ranging from Strongly Up, Slightly Up, About The Same, Slightly Down and Strongly Down.

"To build the Consumer Sentiment Index, we ask our vendors the following question: Where do you expect home prices to be in your area is six months' time?"

This information is then collated to provide the basis for our proprietary index system. The index gives a measure of vendors' expectations for home price movement on a scale of -10 to +10, with a reading of 0 being a neutral view of the market.

Values above +5 indicate strong overall optimism and values below -5 indicate strong overall pessimism.

In 2019 Q4, we collected a total of 2,029 survey responses from OpenAgent customers all across Australia. All of our responses have been weighed against the relevant cohorts at the state level to remove any bias and present a realistic snapshot of sentiment for that group.

Using this methodology, we ensure that the Consumer Sentiment Index is relevant for all vendors, not just OpenAgent's customers.

This regular report includes home price sentiment at a National, State and Metro level, as well as granular information about why people are selling, and what they see as the key factors driving their local markets.

In November 2016, we started compiling anonymised data that captures the sentiment and market expectations of consumers who are actively looking to sell their property.

April 2017 saw the inaugural release of the OpenAgent Consumer Sentiment Report, an ongoing quarterly publication that tracks market expectations of active vendors over time.

The latest instalment of this report, covering sentiment from October 2019 until the end of December 2019, shows some fascinating developing trends in sentiment across Australia, based on a total of over 44,217 responses across 38 months.