What is a property appraisal and why do you need one?

When it comes to buying or selling a property, having a clear understanding of its market value is essential. This is where property appraisals play a crucial role. Whether you're a homeowner looking to sell, a prospective buyer, or simply curious about the value of your property, a property appraisal provides valuable insights.

In this article, we will take a look at the concept of property appraisals, explaining what they are and why you need one. By the end, you'll have a good understanding of the benefits of obtaining a property appraisal and how it can empower you in making informed decisions in the world of real estate.

What is a property appraisal?

A property appraisal or a real estate appraisal is a professional assessment of a property's market value, determined through an expert evaluating various factors including:

- The property’s condition

- Where the property is located

- Comparable sales in the area

- Current market trends

The overall aim is to determine an unbiased estimate of the property's worth in the current market. This can be useful to parties including sellers, buyers and lenders.

Why you need a property appraisal

At some point in your real estate journey, you’re going to need a property appraisal. A property appraisal is not just a routine process; it is an important tool that provides clarity, confidence, and informed decision-making.

It's a good a idea to get property appraisal if you are:

Selling or buying a property

For sellers, an appraisal provides pricing guidance, helping them set a realistic listing price and giving them a marketing advantage by showcasing the property's value.

Buyers benefit from appraisals by gaining confidence in paying a fair price and using the appraisal report as negotiating leverage if the value comes in lower.

Refinancing or securing a home loan

If you're considering refinancing your mortgage or securing a loan against your property, the lender will often require a property appraisal to assess the collateral value.

This appraisal helps lenders determine the maximum loan amount they are willing to offer based on the property's current market value.

Wanting to understand your equity or wealth

A property appraisal can assist in valuing your equity by providing an accurate market value assessment of your property. By subtracting the outstanding mortgage or loan balance from the appraised value, you can determine the equity you hold in the property. This information can also be valuable in understanding your financial position and level of wealth.

Property appraisal VS valuation - what's the difference?

While property appraisals and valuations are similar in determining a property's worth, there are some distinctions between them. Here are some differences:

- Property appraisals are typically conducted by licensed real estate agents while valuations are performed by a certified property valuer

- Appraisals tend to be more informal as they are simply an opinion or estimate, while valuations are documented on an official report, typically requiring an extra service fee

- Property valuations consider a broader range of factors and are typically used for taxation, legal matters, or investment purposes.

- Appraisals focus on market value and are a quick and easy way to gauge the value and investment potential of a property

Steps to getting a property appraisal

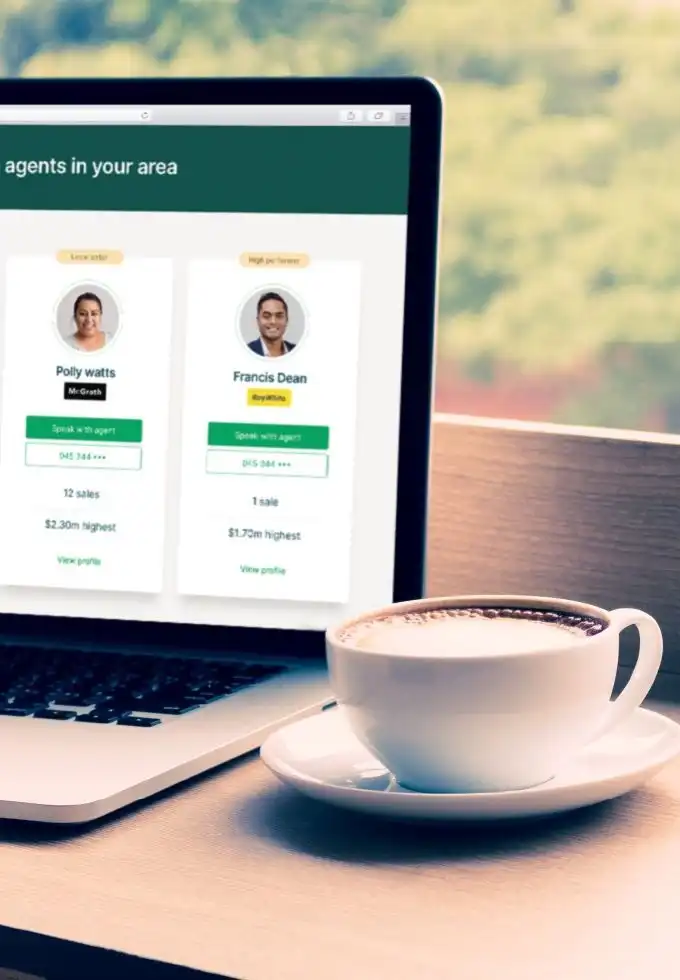

1. Find a licensed real estate agent or appraiser

Search for a licensed and qualified real estate agent or appraiser who specialises in property appraisals in your local area.

2. Schedule an inspection

Arrange an appointment for the appraiser to visit your property and assess its size, condition, features, and any recent improvements.

3. Provide information

Share relevant details about your property, such as recent upgrades or renovations, to help the appraiser gain a better understanding of its value.

4. Market analysis

The appraiser will research recent comparable sales in your area to determine the current market value of your property.

5. Get your appraisal

Based on the inspection and analysis, the appraiser will provide a professional opinion of your property's market value.

How do I get an appraisal on my property?

To get an appraisal on your property, you should:

- Find a licensed real estate agent or appraiser in your area

- Schedule an inspection

- Provide relevant information about your property that the appraiser may not know about

- Get your appraisal

How do property appraisals work?

A property appraisal involves a licensed real estate agent or appraiser calculating the approximate value of the property. This is done by taking into account factors such as: the property’s condition, where the property is located, comparable sales in the area and current market trends.

How much do property appraisals cost?

Many real estate agencies in Australia provide a free property appraisal service. However, it's important to understand that a property appraisal is an estimation and does not hold any legal authority.

Valuations on the other hand can cost anywhere between $200-$600, varying depending on the size and type of your property.

What information is needed for a home appraisal?

Information required for a home appraisal include:

- Property Details- the appraiser will need basic information about the property, such as its address, lot size, square footage, number of bedrooms and bathrooms, and any additional features like a garage or swimming pool.

- Comparable Sales - the appraiser can determine the property's market value by comparing it to similar properties that have recently sold.

- Underlying issues - appraisers evaluate various factors, including structural problems, pest infestation and deferred maintenance. These underlying issues can affect the property's value and are taken into consideration during the appraisal process.

- Additional Documentation - the appraiser may request additional documentation, such as property tax records, floor plans, property surveys, or any relevant permits for renovations or additions.

What does it mean when a property is appraised?

When a property is appraised, it means that a professional appraiser has assessed its value based on various factors such as its location, size, condition, comparable sales, and market trends. The purpose of the appraisal is to provide an objective and unbiased estimate of the property's worth.