August home values surge ahead despite lockdowns

Over the past few months we've seen Australian property price growth cooling off from its March boiling point, and that's again the case in August.

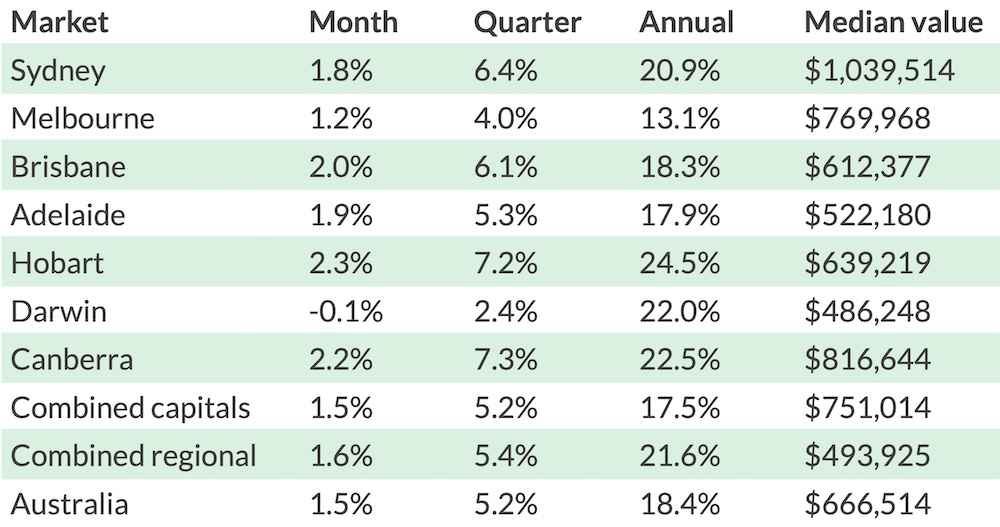

A +1.5 per cent increase in median property values for the month, according to CoreLogic's latest Home Value Index, is a significant pullback from the +2.8 per cent mania of March 2021, although it's still well above the thirty-year average.

Affordability constraints are keeping somewhat of a lid on growth and lockdowns have listings tumbling, yet buyer demand is still very strong relative to stock on the market, so there's good news for sellers amongst the uncertainty.

National property values: August 2021

| Median property value | Monthly change | |

| Houses | $707,263 | +1.6% |

| Units | $583,584 | +1.2% |

August's +1.5 per cent bump in national values means today's median Australian property costs $666,514. That's just shy of a $10,000 increase from July.

To add a bit of perspective, the median property price as of January 1st was $574,872.

That means values have charged up roughly $2,640 per week over the past eight months.

The gradually easing rate of growth is likely more a consequence of affordability pressures than ongoing Covid restrictions, CoreLogic's research director Tim Lawless explains.

"Housing prices have risen almost 11 times faster than wage growth over the past year, creating a more significant barrier to entry for those who don't yet own a home," he says.

"Lockdowns are having a clear impact on consumer sentiment, however to date the restrictions have resulted in falling advertised listings and, to a lesser extent, fewer home sales, with less impact on price growth momentum.

"It's likely the ongoing shortage of properties available for purchase is central to the upwards trend on housing values."

Canberra once again demonstrated the biggest rise of the month, making for a staggering +7.3 per cent jump in prices for the quarter, while Darwin's rapid deceleration meant it was the only city to return negative growth.

Hobart, Brisbane and Sydney also turned in above-average gains in August, and Melbourne's more muted run continued with a +1.2 per cent bump.

The regional markets performed slightly better than their capital city counterparts on average, with Tasmania and NSW both breaking the +2.0 per cent barrier.

Listings are way down but buyer demand and sale prices remain relatively high

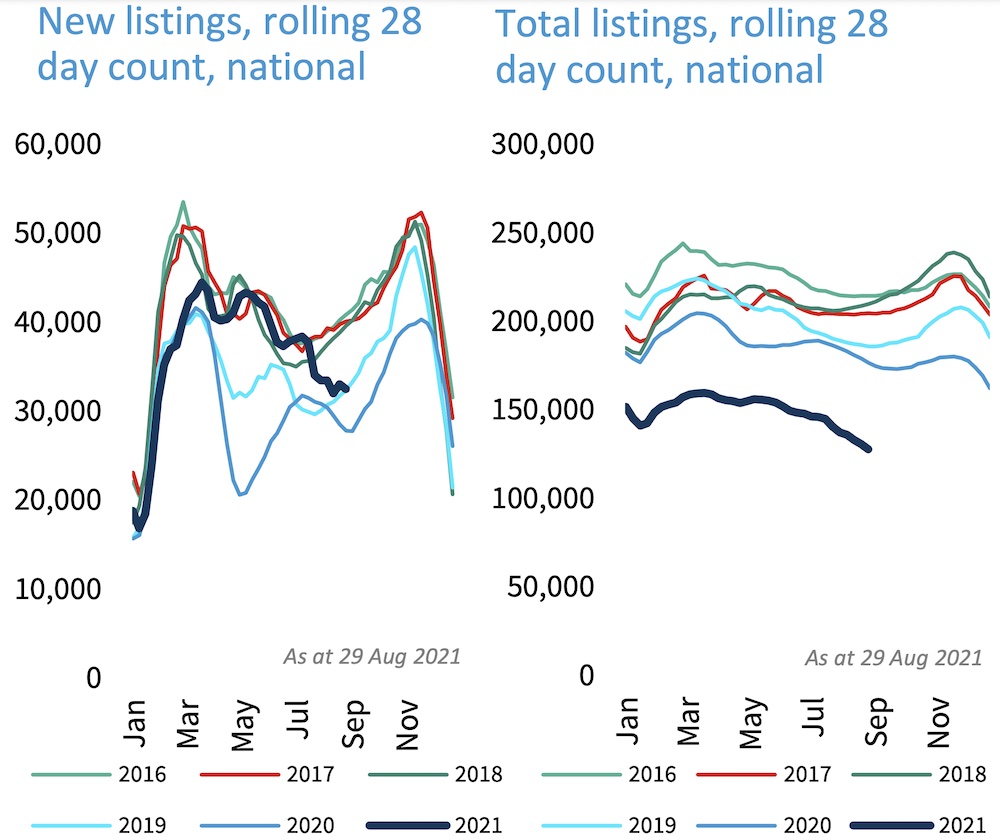

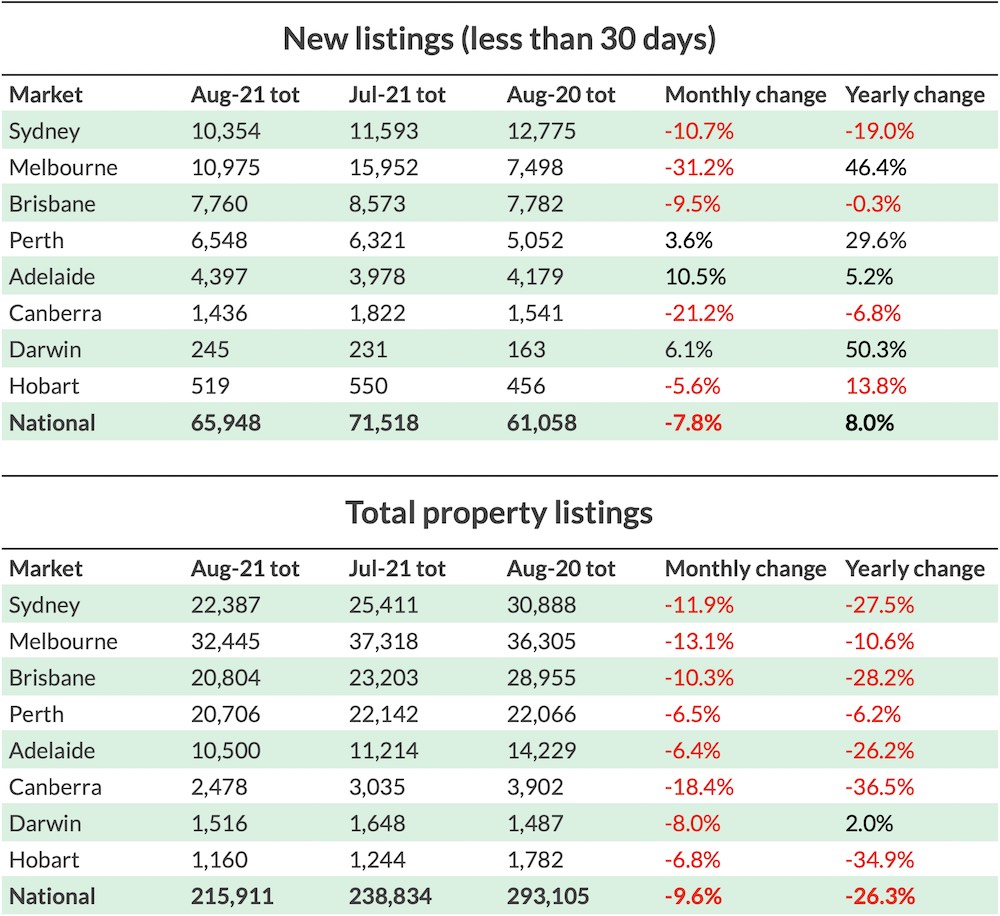

The major effect of lockdowns and the spreading uncertainty they've brought to the market have meant listings have slumped.

CoreLogic's report explains that "due to both lockdowns and and seasonal factors, the number of new listings through August dropped to -5.8 per cent below the five-year average and total active listings were -29.4 per cent below average"

SQM Research has also reported on the rapidly declining listing numbers across the country, showing huge drops in both new and total listings in nearly every city.

While CoreLogic notes that sales over the same August period are down -9.0 per cent nationally, that number in relation to the reduction in listings means there has been a net rise in demand.

Although there has recently been a trend towards fewer buyers, the past three months has seen the number of home sales remain +30 per cent above the five-year average at a time when active listings are -29 per cent below average," Mr Lawless says.

Essentially, the balance of power is still well and truly on the side of sellers.

"We are still seeing a disconnect between advertised supply and housing demand, even in the cities where lockdown restrictions are active, which is keeping upwards pressure on housing prices despite challenges faced by both buyers and sellers."

Auction clearance rates demonstrate 'strong selling conditions'

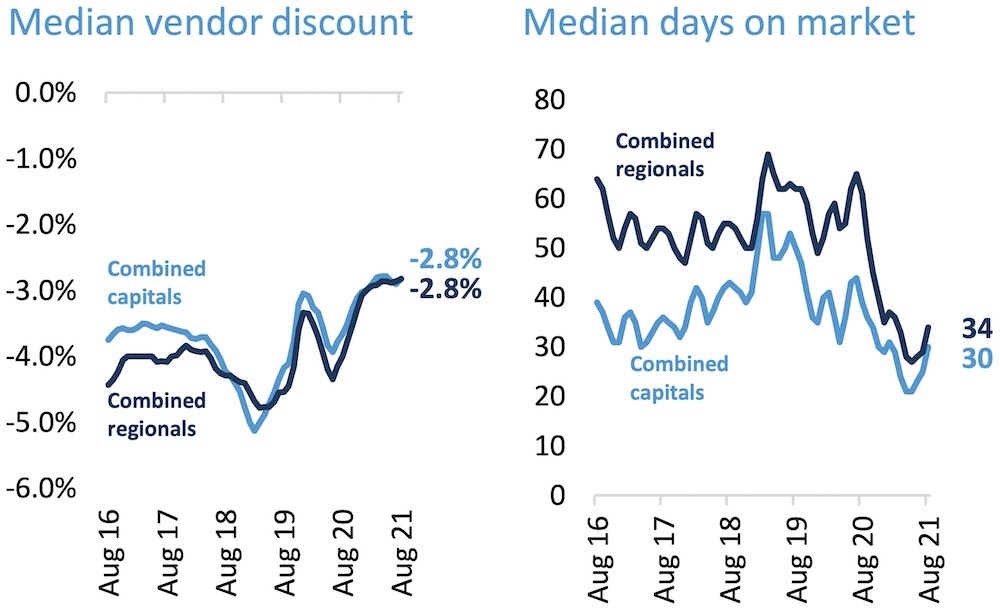

CoreLogic's report points out that, while the number of sales have dropped lately, the success of properties that do go on to sell demonstrates strong selling conditions.

"Auction clearance rates have trended lower, especially in Melbourne where a large proportion of auctions have been withdrawn from the market," Mr Lawless explains.

"However, where properties have proceeded to market, the large majority are recording a successful result, albeit with a large proportion selling prior to the auction rather than under the hammer."

That's reinforced by days on market—the amount of time a property takes to go from listing to sold—being down to between 30 and 35 days, including for cities in lockdown.

Vendor discounts are also at record lows, which the report says implies "most vendors aren't budging much on their initial pricing expectations."

The gap between units and houses is just starting to get smaller

Throughout the 2021 property boom, houses have been well and truly leading the charge while unit growth has hung back a bit more.

Over the past 12 months, the national median house price is up +20.8 per cent compared to +10.5 per cent for units.

There looks to be a slight narrowing of that gap, though, as buyers who have been priced out of the house market look back to units as a viable option.

CoreLogic's report notes that, in the first quarter of 2021, capital city house prices were rising +1.1 per cent faster than units, whereas in August that difference is down to +0.7 per cent.

"The narrowing gap between house and unit value growth is most noticeable in Australia’s most expensive city, Sydney, where the monthly growth rate for houses was 2 percentage points higher than units in March," Mr Lawless says. "That 'gap' has now reduced to 0.6 percentage points in August."

The same trend isn't being seen everywhere, though. Melbourne and Brisbane, two markets which are known to have an oversupply of inner-city apartments, are seeing that house and unit gap continue to widen.

What comes next?

We're back in uncharted waters as far as the pandemic goes, and it's hard to find any certainty in what the coming months have in store.

CoreLogic predicts the usual spring listings rush will proceed in major markets like Brisbane, Adelaide, Perth and Hobart, however locked down cities like Sydney, Melbourne and Canberra will continue to see reduced activity, both in terms of listings and sales.

In those lockdown markets especially, the net increase in demand should mean vendors continue to achieve high prices while stock dwindles even further.

Looking further ahead, the expectation is that we'll see some similarities to past extended lockdowns, particularly in terms of a rebound once things open back up.

Westpac's latest Housing Pulse report says "on balance, we expect the situation to see a temporary loss of momentum rather than a correction—even in the most heavily impacted areas—and a rapid snap-back once restrictions ease."

For now, CoreLogic tip affordability issues to keep dampening the market, and the potential for credit tightening down the track could also reduce buyer demand.

"A lift in advertised supply in the absence of more buyers could be another factor that weighs on price growth later this year," the report reads.

The future is unclear, but for now it looks like conditions are strong for sellers still willing to make a move.