Low supply, high demand brings strong NSW growth in lockdown

Greater Sydney has already been locked down for more than two months and the rest of NSW has endured stay-at-home orders for weeks now, yet property prices in the state continue to rise at a rapid pace.

According to CoreLogic's latest Hedonic Home Value Index, Sydney's median house price has risen by close to $280,000, or +23.3 per cent, since the beginning of this year. That's more than $8,000 a week.

Houses in regional NSW are up by close to $120,000, or +19.4 per cent, since the start of January, meaning the median house has seen gains of over $3,300 per week.

With staggering numbers like that, the question on everyone's lips is: can it continue?

Sydney market update

| Houses | Units |

|---|---|

| $1,293,450 | $824,514 |

| Monthly change: +1.9% | Monthly change: +1.4% |

The relentless momentum of Sydney real estate brought the city's median property value up past the $1 million mark last month, and in August it saw another bump of around $22,000 up to $1,039,514.

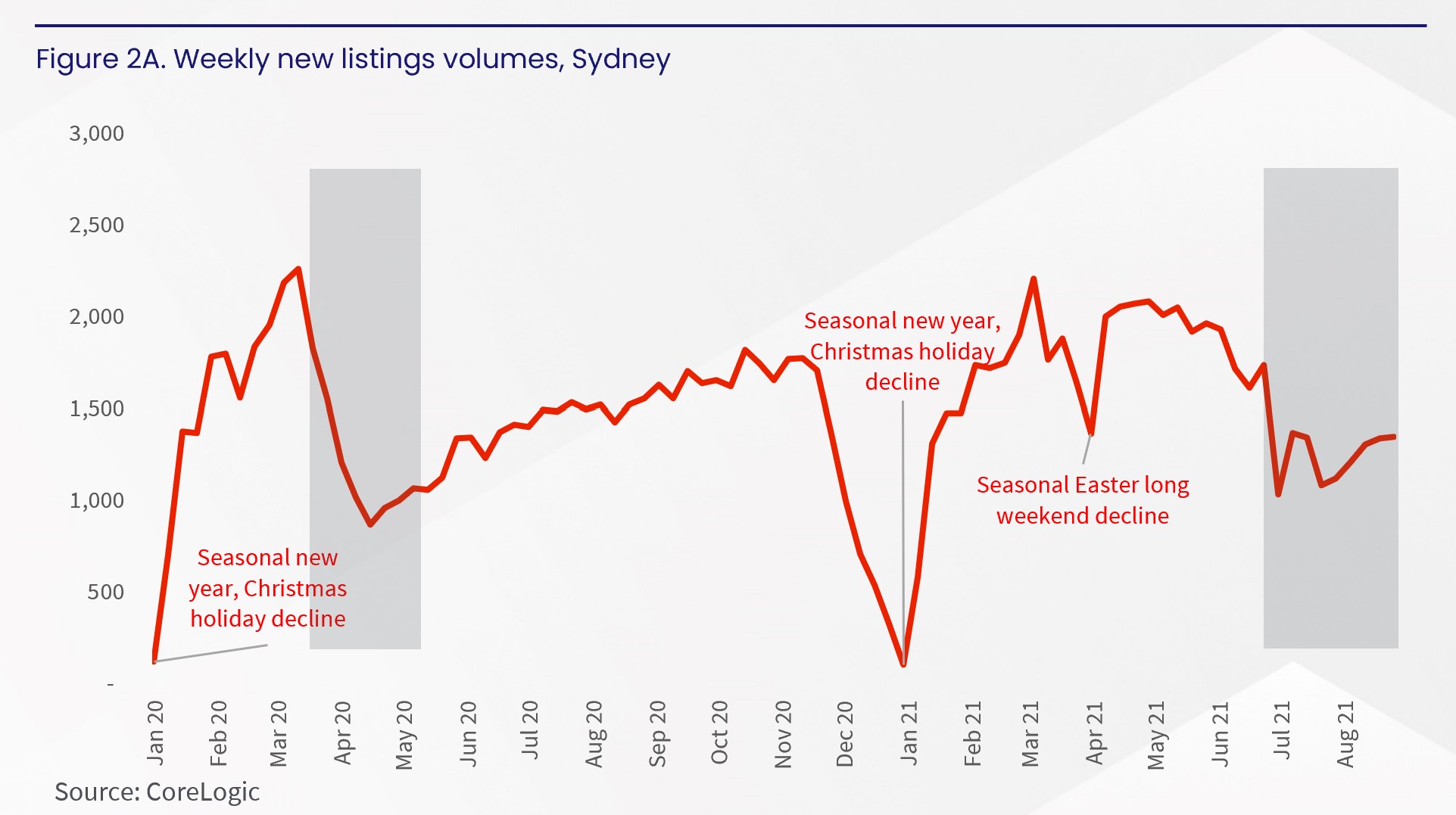

An extended period of lockdown has seen new listings on the market fall dramatically, but it's deterred uncertain sellers more than buyers, and the increase in net demand has continued to push prices higher.

When it comes to restrictions around buying and selling property, the rules in Sydney mean in-person inspections can still go ahead, as can things like home staging, renovations and photography, so compared to other states the market has managed to tick along with relative freedom.

Auction clearance rates—still well above 80 per cent in the past few weeks—demonstrate a high ratio of successful sales under the virtual hammer, and plenty of deals are also being secured prior to auction.

With prices reaching new record highs each month, affordability constraints look to be pushing some buyers—first home buyers especially—from houses towards units as they readjust their expectations.

At the height of this boom back in March, house prices were growing 2.0 per cent faster than unit prices, however, that gap has now narrowed down to 0.6 per cent.

Regional NSW market update

| Houses | Units |

|---|---|

| $638,278 | $516,257 |

| Monthly change: +2.0% | Monthly change: +1.8% |

The Sydney property market always takes the lion's share of the headlines, but real estate in regional NSW is still surging upwards at a rate of knots, and in fact outpaced the capital in August.

The median property value in regional NSW increased by a full +2.0 per cent in the last month, ahead of Sydney's +1.8 per cent, bringing year-to-date growth to +19.0 per cent

Also, while city house and unit prices have grown at significantly different rates, the different property types are neck and neck in the regions, having risen +6.5 per cent and +6.3 per cent respectively over the past three months.

This all points to the notion that the sea and tree-change trend sparked by the pandemic is still well and truly ongoing.

REA's latest Property Market Outlook report notes that regional properties are still being snapped up quickly, too. Homes in Newcastle and Lake Macquarie, for example, were listed on realestate.com.au for an average of just 26 days in July before being sold, with Illawarra close behind on 28 days.

Westpac's August Housing Pulse report points out that, while there has been "slight moderation" in Byron Bay prices, the rest of the state's regional markets are still seeing "strong momentum."

Consumer confidence is faring better than in 2020

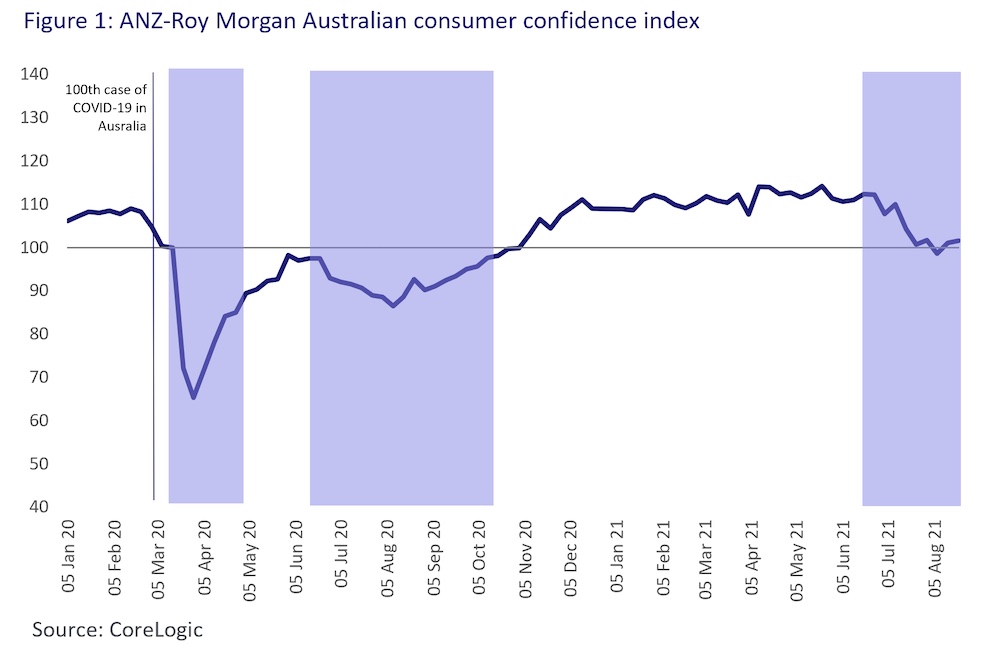

When Covid first hit last year and the first wave of lockdowns sent the economy and property market into a sharp descent, consumer sentiment took a big hit as well.

Uncertainty and fear led sellers to retreat from the market and Sydney home sales dropped -36.7 per cent in April 2020 as the country tried to comprehend what was going on.

Thankfully, 18 months on, the current lockdowns haven't rattled people to the same degree. As CoreLogic explore in a new report, consumer sentiment has shown more resilience in 2021 and, while total sales are still down as a result of restrictions, there's significantly more optimism about the present and future.

The ANZ-Roy Morgan Australian consumer confidence index shows that, even two months into Sydney's lockdown, respondents have an overall positive outlook now that we have a better understanding of what to expect from Covid and the post-lockdown recovery.

CoreLogic points out that "consumer sentiment is an economic indicator that is generally positively correlated with home sales."

All this is to say that, with consumers feeling more optimistic about the future—particularly their financial future—the property market is likely primed for more upward momentum as the months go on.

What's next for the Sydney and NSW markets?

Of course, there's no knowing exactly when and how NSW will emerge from the current Covid restrictions, but 2020 provides some strong indicators of what might happen.

CoreLogic says "housing market activity bounced back quite quickly following previous spot lockdowns and after Melbourne's extended lockdown late last year, and we are expecting a similar turn of events once restrictions are eventually lifted."

Once some normality returns, there are clear expectations that pent-up supply will hit the market in droves. There are question marks around whether buyer demand will rise to the same degree, so there is a chance the influx could see growth easing significantly.

In the meantime, a substantial shortage of stock on the market that isn't keeping up with buyer demand should continue to see many sellers fetching high prices.

Westpac's Housing Pulse report says "demand continues to run well ahead of on-market supply—with sales outstripping new listings by about 20 per cent."

What's around the corner is anyone's guess, but for now, NSW broadly remains a seller's market.