How will the latest lockdowns affect the property market?

After a relatively smooth first half of the year as far as the pandemic is concerned, much of Australia is once again grappling with lockdowns—some short and jolting, others long and tedious, all of them very much unwanted.

For many businesses and industries, the new wave of restrictions has been devastating, but given the momentum behind the property market, it seems like even whole-state shutdowns might not be enough to stop the 2021 boom.

So what comes next? We look to a range of industry experts, ranging from agents to big bank economists, to find some answers.

Listings are down but demand is still high

One clear consequence of the recent lockdowns, particularly in Sydney and Melbourne, is a drop in property listings as sellers lose confidence in the current conditions.

Michael Yardney wrote on his popular Property Update blog that "vendors are reluctant to put their properties on the market due to the uncertainty caused by the latest wave of Covid outbreaks and lockdowns at a time when it’s difficult for potential purchasers to inspect their properties."

While there may be a dip in the amount of stock coming to the market, though, demand from buyers hasn't fallen to the same degree, and that's reflected in sales figures.

Mr Yardney pointed out that in Sydney, while listings are down -36 per cent month on month, property sales are only down -29 per cent, implying a net rise in demand.

In Melbourne, listings are down -71 per cent compared to a -40 per cent drop in sales. Brisbane listings have fallen only -1 per cent while sales are up +7 per cent.

As Mr Yardney said, "despite increasingly onerous lockdowns, our pandemic-stricken housing markets just keep rising."

REA's director of economic research Cameron Kusher echoed Mr Yardney's sentiment, saying "vendor confidence is clearly being damaged by lockdowns and not just in those areas where lockdowns are occurring but across most parts of the country.

"If anything, lockdowns are making it tougher for buyers because it is leading to less stock available for sale, so you have the same volume of competition but a much shallower pool of properties that people are competing for."

The industry continues to adapt to buying and selling online

There's no doubt that lockdowns have presented significant roadblocks for anyone looking to transact on property.

There is, however, far better infrastructure in place to keep the real estate industry ticking along in lockdown since the start of the pandemic, and buyers, sellers and agents are all better equipped to go navigate the virtual sale process.

Ray White's chief economist Nerida Conisbee said she was surprised by how well Sydney buyers in particular were taking to the online realm, saying "while market confidence is different, I don’t think anyone expected bidders at auctions to soar by this much in a lockdown.

"Buyers have found the process of taking part at an online auction to be much easier than an in-person event, but also there is a lot of confidence out there."

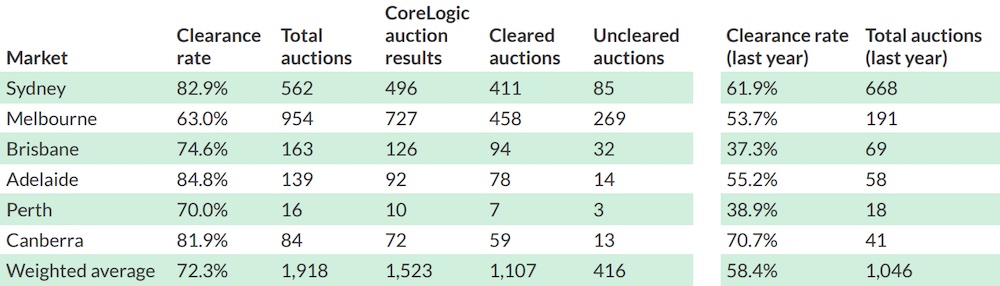

The latest clearance rate data from CoreLogic suggests that auctions are still successfully going ahead via the web.

While the total number of auctions taking place has reduced, the latest clearance rate in Sydney is still up at a staggering 82.9 per cent.

Brisbane is at a very healthy 74.6 per cent, while Melbourne, currently going through a highly uncertain period in its sixth lockdown, fell to 63.0 per cent—although the total number of cleared auctions was above that of Sydney.

Shiv Nair, an agent at Harcourts Hills Living in Sydney's Baulkham Hills, has seen people quickly adapting to the city's restrictions and forging ahead with their sales and purchases.

"Buyers at the moment are very educated on how to book appointments, how to view properties, the protocols they have to follow, and even with virtual auctions the buyers at the moment are very much used to it," he said.

"So I think everyone knows that things are different at the moment, and we have to take a different approach to how we sell and purchase property. it's been good to see that everyone's working together to buy and sell property."

How will prices be affected?

After this year's staggering nationwide property boom, it's the question on everyone's lips: will the latest lockdowns put the brakes on price growth?

While it's impossible to predict how the current Covid situation will play out over the coming months, experts appear to be unified in their expectations that property prices will continue to rise, even if that growth is delayed to some degree.

Westpac economists Bill Evans and Matthew Hassan wrote that "lockdowns will see some loss of momentum in the third quarter [of 2021], particularly in the Sydney market, but an eventual easing in restrictions should see activity rebound swiftly and price growth lift again into year end."

They still forecast national growth of +18 per cent for 2021 as a whole, followed by a further +5 per cent in 2022.

Whenever cities or regions emerge from their respective lockdowns, they expect any Covid-influenced slowdowns will be reversed due to pent-up demand from both buyers and sellers.

But in the short term, it's likely that markets in lockdown will experience a cooling of the action while uncertainty lingers. And that might just present a golden opportunity for sellers looking to make the move before the rush hits.