Property clock: is your city on the verge of a boom?

The latest Residential Property Report March 2021 by Independent property valuation firm Herron Todd White (HTW) reveals the markets around the country that are rising, at their peak and declining.

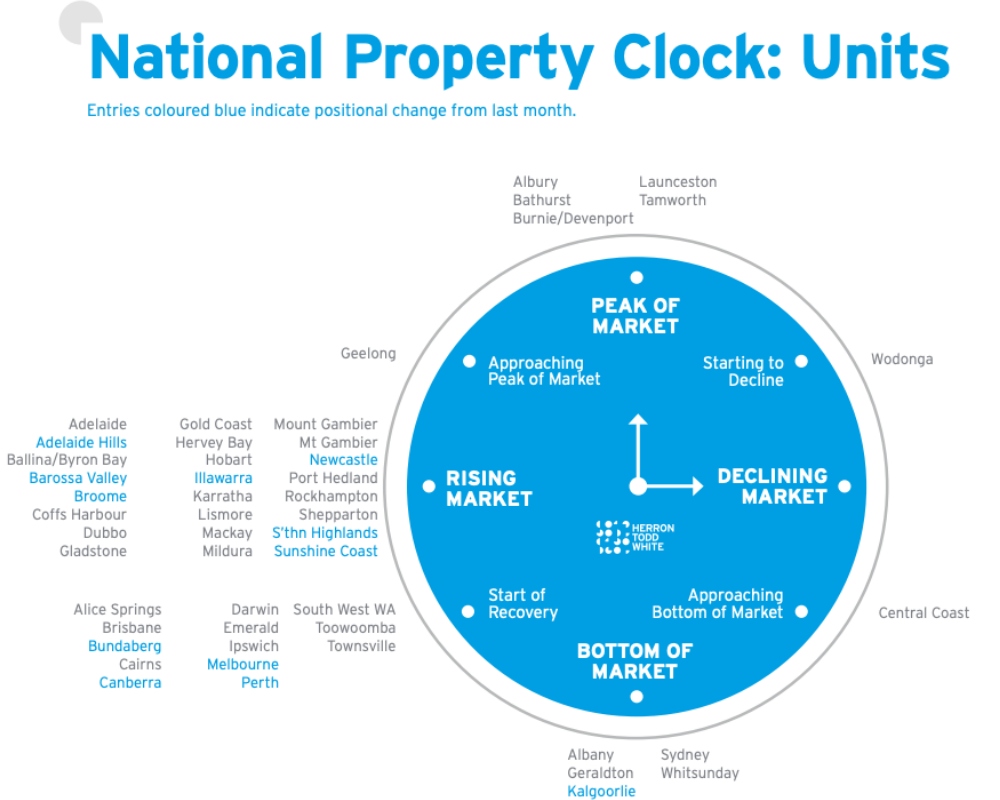

The monthly report analyses the major cities and regions around Australia and provides insight into where these markets are in their property life cycle using a “property clock”.

Overall, the outlook for houses and units is looking very optimistic with the majority of the regions and cities placed in the “rising market” category with only a handful of areas declining or hitting the bottom of the market.

The analysis reveals that houses in Canberra, Launceston and Bathurst are at the peak of the market while seven of the eight capital cities are in a rising market.

This is not surprising, with the latest CoreLogic national home value index recording a +2.8 per cent rise in March, the fastest rate of appreciation since 1988.

The strong growth conditions have also been broad-based with values rising by +1.4 per cent across each of the capital cities and ‘rest-of-state’ areas over the month.

Wodonga is the only city that is starting to decline, with Kalgoorlie, Albany and Geraldton bottoming out.

Markets in recovery

The property clock shows that houses in Alice Springs, Bundaberg, Broome and Darwin are starting to recover.

According to HTW Property Valuer Jeremy Callan, the increased demand for property in Darwin in the second half of 2020 has carried through into 2021.

“The majority of this recent uplift has been driven by first homeowners looking to access government incentives to either build new or buy an existing home or by existing homeowners moving from interstate,” he said.

For units, Melbourne, Perth and Canberra are among the cities that are in a state of recovery after a challenging year in 2020.

The report states that while high rise apartments in Melbourne CBD continue to have high vacancy rates and lower rents, other areas such as the South-East have garnered more demand as renters focus more on lifestyle areas.

The rising markets

Houses in Sydney, Melbourne, Adelaide, Perth, Darwin, Brisbane and Hobart are amongst the cities in a rising market.

Other regions include the Sunshine Coast where very low stock levels and strong demand continue to push property prices up.

According to HTW Director Stuart Greensill, the market in the Sunshine coast has continued to gain strength with the fear of missing out becoming more evident.

“The market is extremely dynamic with upward pressure on values so we are seeing new value benchmarks being set.

“At first this trend started in the northern Sunshine Coast region around Noosa Heads. This has now stretched right across the Sunshine Coast.

“What is becoming apparent is that when we look at the level of competition … purchasers coming from an external market (say Sydney or Melbourne) will look at a property and all its attributes and think it’s pretty cheap compared to where they came from.”

Barossa valley, Adelaide Hills and Newcastle are among the rising markets for units.

According to Tom McDouall, Associate Director of HTW, the Newcastle and Hunter region has seen a steady rise in investor activity over the last six months.

“The region has seen the lowest vacancy rates for rental properties for the last 20 years which is great news for investors,” he said.

“A lot of investors from Sydney and north of Newcastle have been reported at open houses all over the region.”