Property clock: is your market still on the up?

Each month, independent property valuation firm Herron Todd White (HTW) takes the temperature of 50 of Australia's top markets in their Residential Month in Review report.

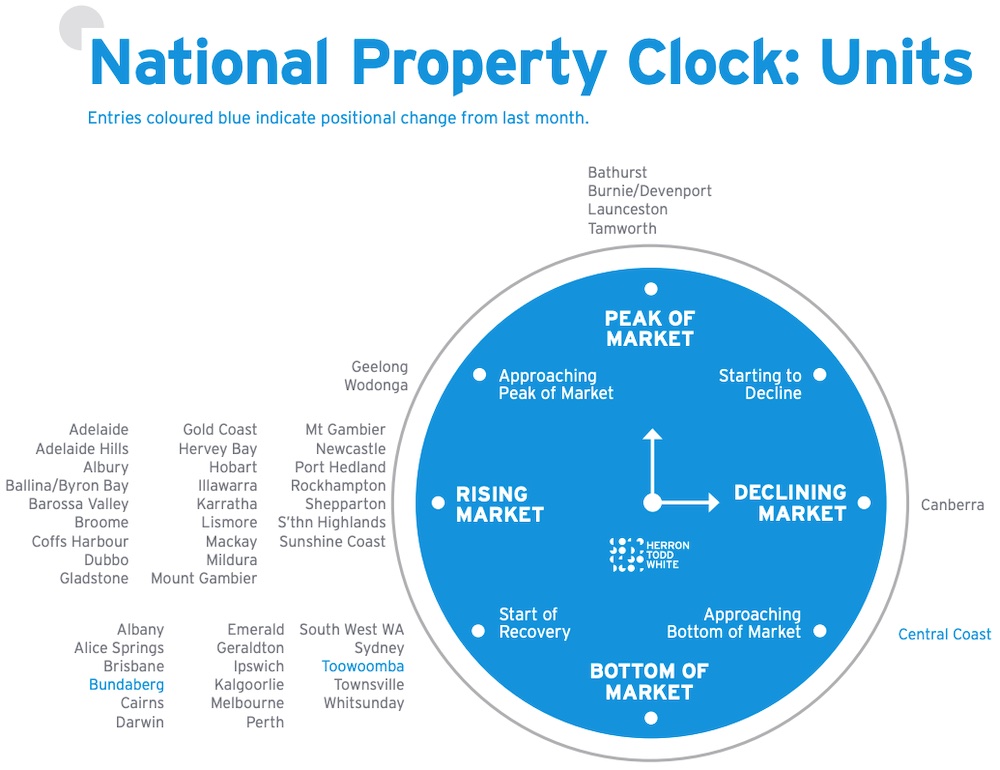

At the front end of the report are their property clocks—a visual representation of where each market sits in the cycle, be it rising, peaking, declining or bottoming out.

Now that we're halfway through 2021, this edition of the report takes stock of the year so far and, perhaps not surprisingly, finds "mostly robust markets across the nation."

Not every city and suburb is on equal footing, though, and as HTW points out, "the Australian real estate market is not a simple beast."

So where do the top markets land on this month's property clock?

Cities at or approaching their peak

"A sense of confidence flowed through many centres fuelled by low interest rates, bullish returns to economic form and substantial government assistance," the report explains.

As a result, "buyers who'd been keeping their powder dry were suddenly given a hurry up, as activity and price growth gained momentum."

Things have been moving rapidly across the country, and it's pushed some markets to a point that HTW considers to be either at or close to their peak.

They expect that the explosive growth Canberra houses have seen over the first half of this year (+14.4 per cent according to CoreLogic) can't be sustained for much longer, and as a result the capital has hit its peak for this cycle.

On the border of NSW and Victoria, houses in Albury have also hit that midnight sector of the property clock, with neighbouring Wodonga following close behind.

Houses in regional centres Tamworth, Dubbo, Bathurst, Launceston and Burnie/Devenport join things at the peak, while Geelong, which has also seen rapid growth so far in 2021, is on its way up there.

The units version of the clock paints a very similar picture when it comes to the peaking markets.

Cities on the way down or beginning to recover

According to HTW's analysis, while the country's property market as a whole is soaring, there are still some cities and regions where forecasts look a little shakier.

While they have Canberra houses hitting their peak this month, units in the nation's capital are firmly in the 'declining market' segment of the clock.

They explain that the city's unit prices have "have remained stable and steady with around 0 to 5 per cent annual growth rates reported," a long-term trend that's a far cry from Canberra's house successes.

Units on Greater Sydney's Central Coast, where houses have been surging, are also said to be approaching the bottom of the market as buyers seek more spacious, detached homes.

In terms of those markets beginning to recover, HTW says houses in Alice Springs, Broome and Bundaberg are starting to climb their way up as buyer demand strengthens.

Units in major markets like Sydney, Melbourne, Brisbane, Perth, Darwin, which have also mostly been lagging behind substantial house growth, have been placed in the 'start of recovery' sector as well as some oversupply issues look to be easing.

Cities on the rise

That leaves everything else that's on the up, and the 'everything else' category is just about overflowing.

While in many cases growth this year has been massive, HTW look to be convinced that the momentum will continue to push prices north, at least in the short term.

In terms of houses, Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart and Darwin all feature on the list of 37 rising markets, joined by regional destinations like Ballina/Byron Bay, the Sunshine Coast, the Barossa Valley, Mildura and Cairns.

Speaking about Melbourne in particular, HTW's director Perron King says "with the majority of people spending more time at home than ever during 2020, many individuals and families took the opportunity, post lockdown, to upgrade their homes."

It's a trend that's continued throughout 2021, and one that has been a boon to regional markets like the Sunshine Coast.

"Something we had not anticipated out of the pandemic was the level of interstate migration the region has experienced," HTW property valuer Cara Pincombe explains.

"It has been reported that in the order of 30,000 people have migrated from interstate to Queensland, with a significant number of those choosing to settle in a regional locality."

With the past month proving Covid is still very much a present factor in Australians' lives, that focus on upgrading housing conditions isn't likely to dissipate any time soon.